Equity-Based Deferral Plans

Restricted Stock Units (RSUs) and Performance Stock Units (PSUs) Deferral Opportunities.

Provide your contact information you would like to learn more about!

The Advantages of Deferring Equity Forms of Compensation

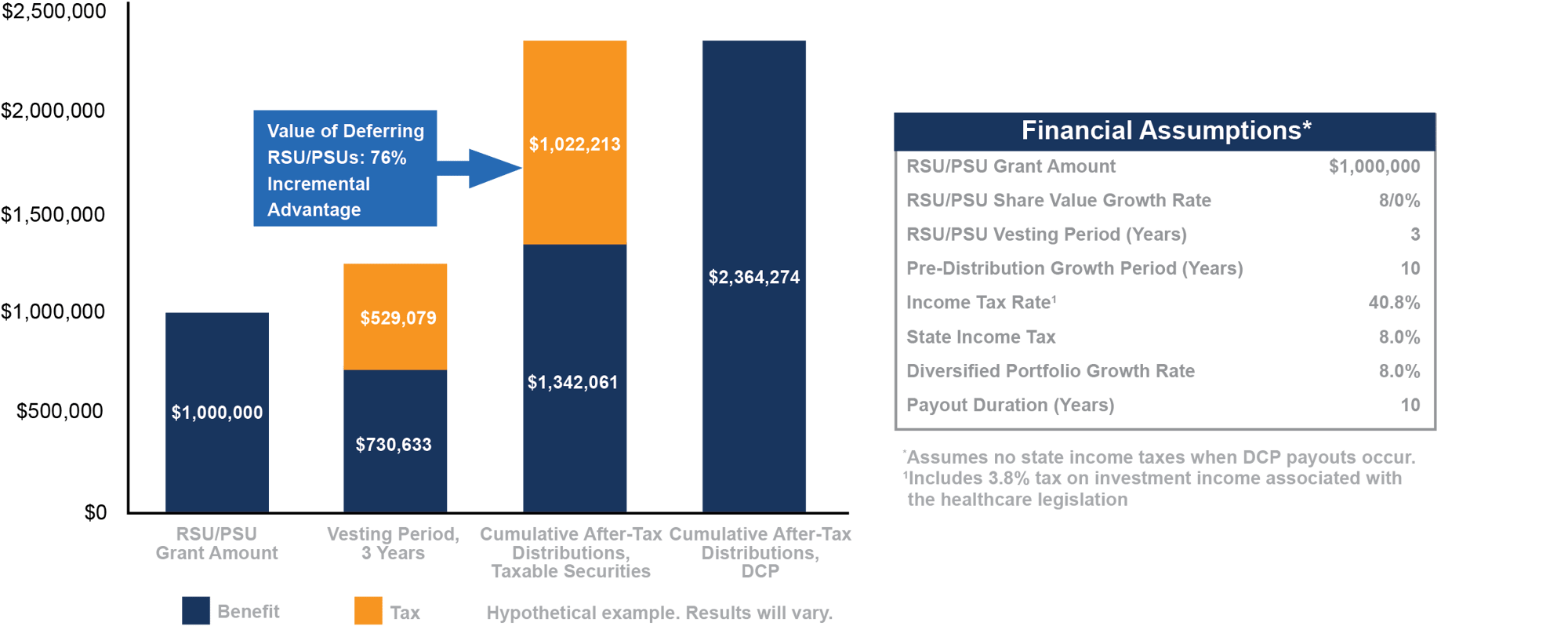

Did you know that the projected cumulative benefits associated with deferring equity-based funds, such as RSUs/PSUs, into a DCP versus receiving them as income can be advantageous for executives and the company’s shareholders?

Plans can be flexible and provide executives with an opportunity to choose from a variety of investment funds.

Advantages of Deferring RSUs/PSUs

- Deferral of income taxes on RSU/PSU value

- Tax-deferred wealth accumulation on an RSU/PSU pretax balance

- Opportunity to preserve equity position upon vesting

- Ability to diversify out of one stock position and into a managed portfolio

- Positive P&L impact to the company

- No cash flow cost to the company