Super Roth™

The advantage of a Super Roth as an executive plan benefit.

Provide your contact information you would like to learn more about!

Establishing a Super Roth as a Plan Benefit.

Distributions from a Super RothTM plan can be taken without tax including the investment gains that have accumulated within the plan. In addition, reallocations are not subject to tax, and assets within the plan can be protected from personal and corporate creditors depending upon the state of residence.

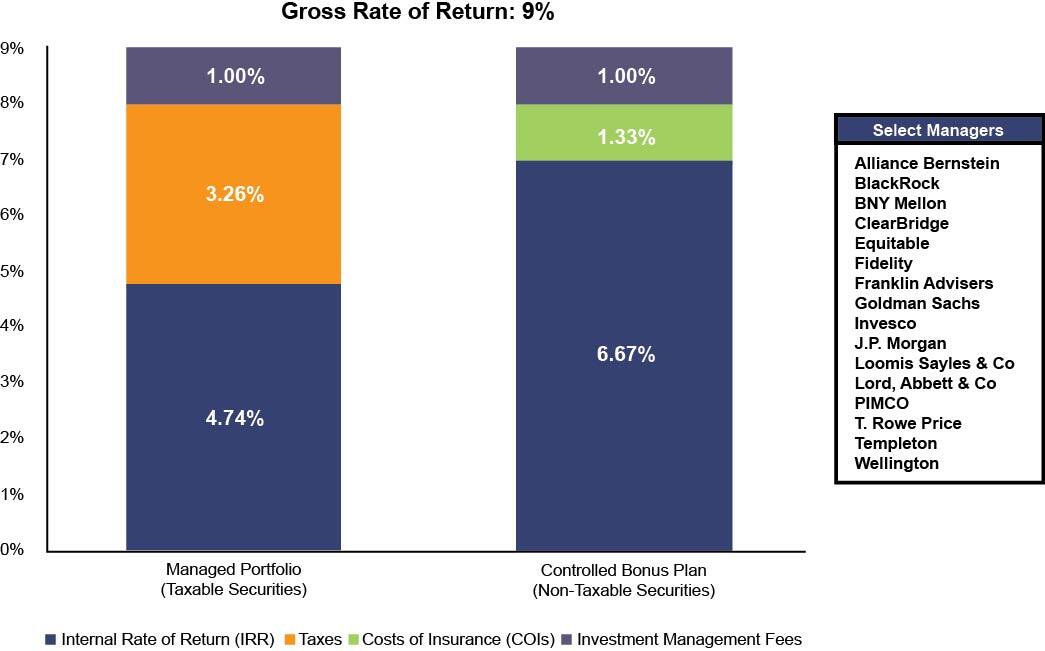

The chart below helps illustrate how implementing a Super RothTM can be an advantage that allows an executive the benefit of contributing unlimited after-tax dollars:

Hypothetical Performance Comparison: Super Roth vs. Taxable Securities

Note: Based on a male, age 45, preferred non-tobacco underwriting, 7 annual contributions of $250K, 40.8% tax rate used for taxable securities and based on a year 20 performance. Taxable securities assumes 100% annual portfolio turnover. For illustrative purposes only. Actual results will vary.