Deferred Compensation Plan

A clear choice in executive benefit plan options.

Provide your contact information you would like to learn more about!

Understanding the benefits of a DCP.

Deferred compensation grows tax-deferred, and the plan is not subject to discrimination testing like qualified retired plans. From the company’s perspective, these compensation deferrals are viewed as a future promise to pay and are typically structured with an offsetting asset to ensure minimal or no P&L impact on the company sponsor. These assets are often held in trust.

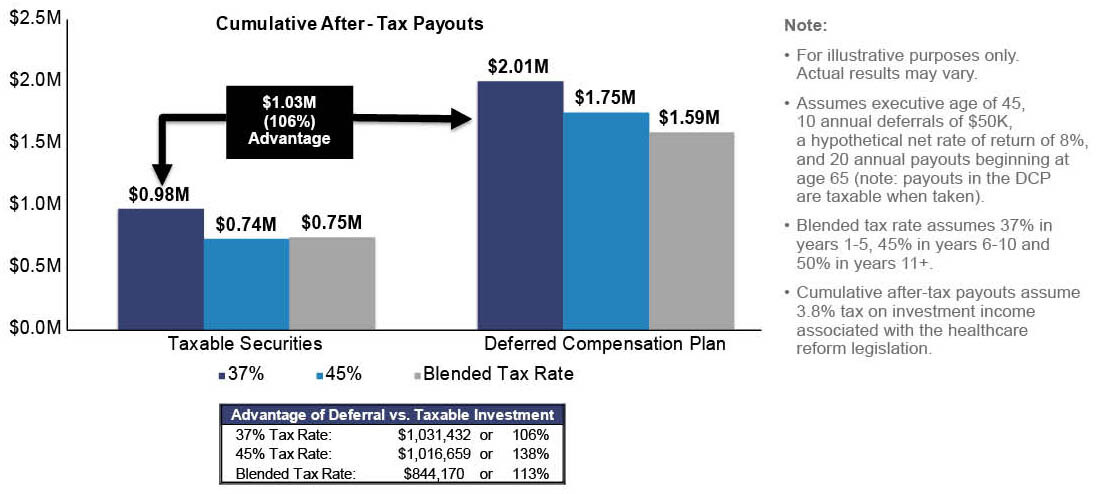

The below hypothetical comparison graphic demonstrates the power of pretax compounding of deferrals invested on a tax-deferred basis:

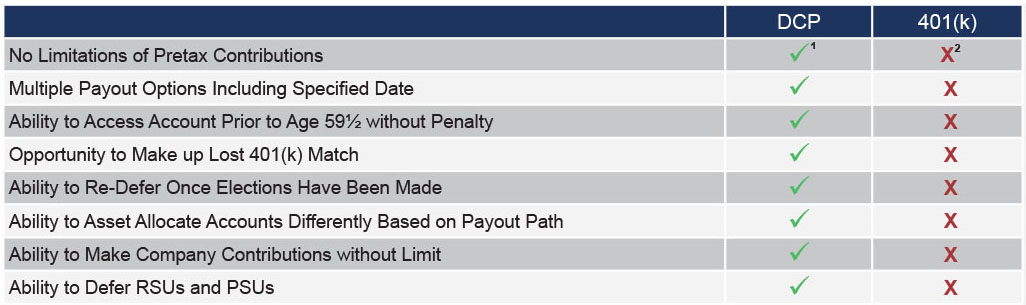

DCP vs. 401(k)

1 $23,500 is the maximum contribution which may be further reduced due to discrimination testing; employees over the age of 50 are allowed a catch-up contribution.

2 100% of total compensation can be deferred into the plan less deductions for benefits and FICA.

Nonqualified deferred compensation plans must follow the guidelines of Internal Revenue Code Section 409A. This tax code section covers the timing of nonqualified plan elections, funding, distributions and documentary compliance requirements. Please consult with the appropriate professional regarding

your individual circumstance.