Private Placement Life Insurance

A life insurance structure to accumulate wealth on a tax-favored basis.

Provide your contact information you would like to learn more about!

Implementing a PPLI solution as a tool for sophisticated investors.

Private Placement Life Insurance (PPLI) is designed for ultra high-net-worth individuals seeking tax-advantaged wealth accumulation and tax protection. Mezrah Consulting helps their clients manage their planning objectives to maximize the benefits of this sophisticated investment structure.

A PPLI investment vehicle allows your investments within in a life-insurance structure to have tax favored benefits. The opportunity to asset protect these PPLI assets is also evaluated, as is the inclusion of a preferred investment manager via an insurance dedicated fund (IDF).

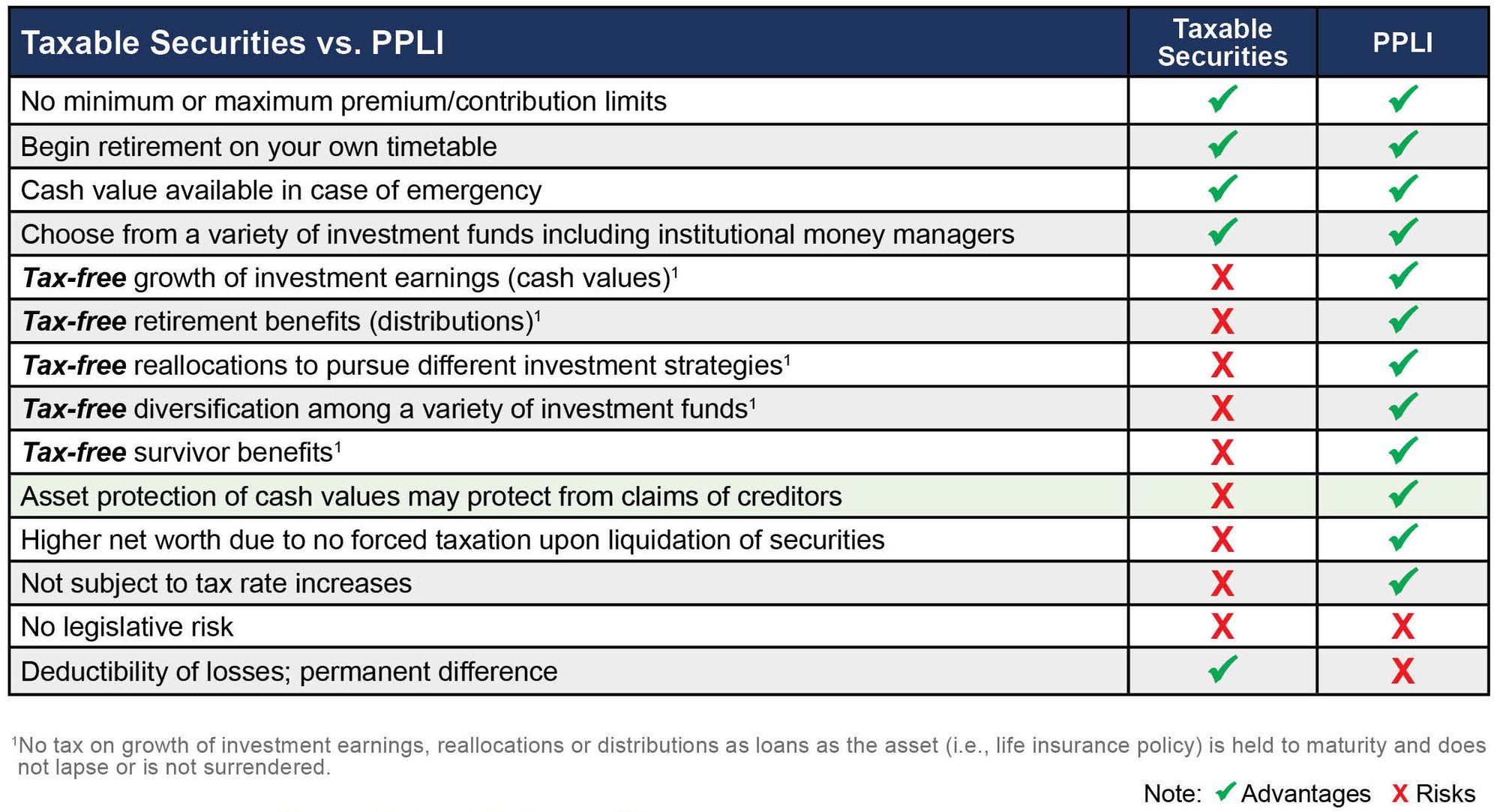

Hypothetical Performance Comparison: Taxable Securities vs. PPLI