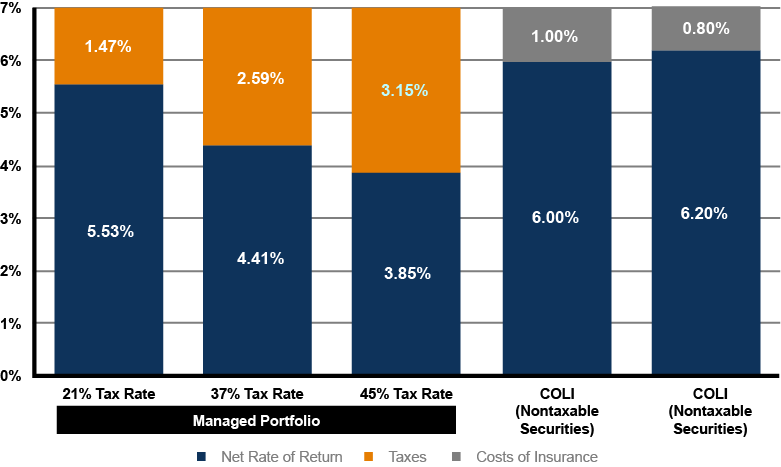

This chart illustrates an indifference curve between taxable and nontaxable securities through a corporate owned life insurance (COLI), highlighting combinations of tax rates and earning rates where an investor is theoretically indifferent to the tax attributes of the funding assets. Combinations of tax rates and earning rates above the curve tend to favor nontaxable securities, while those below the curve tend to favor taxable securities funding.

The selection in funding type is a long-term decision. Therefore, when reviewing the chart, it's important to understand the significance of long-term thinking as it relates to the earning and tax rates.