MSO Deferral Plan™

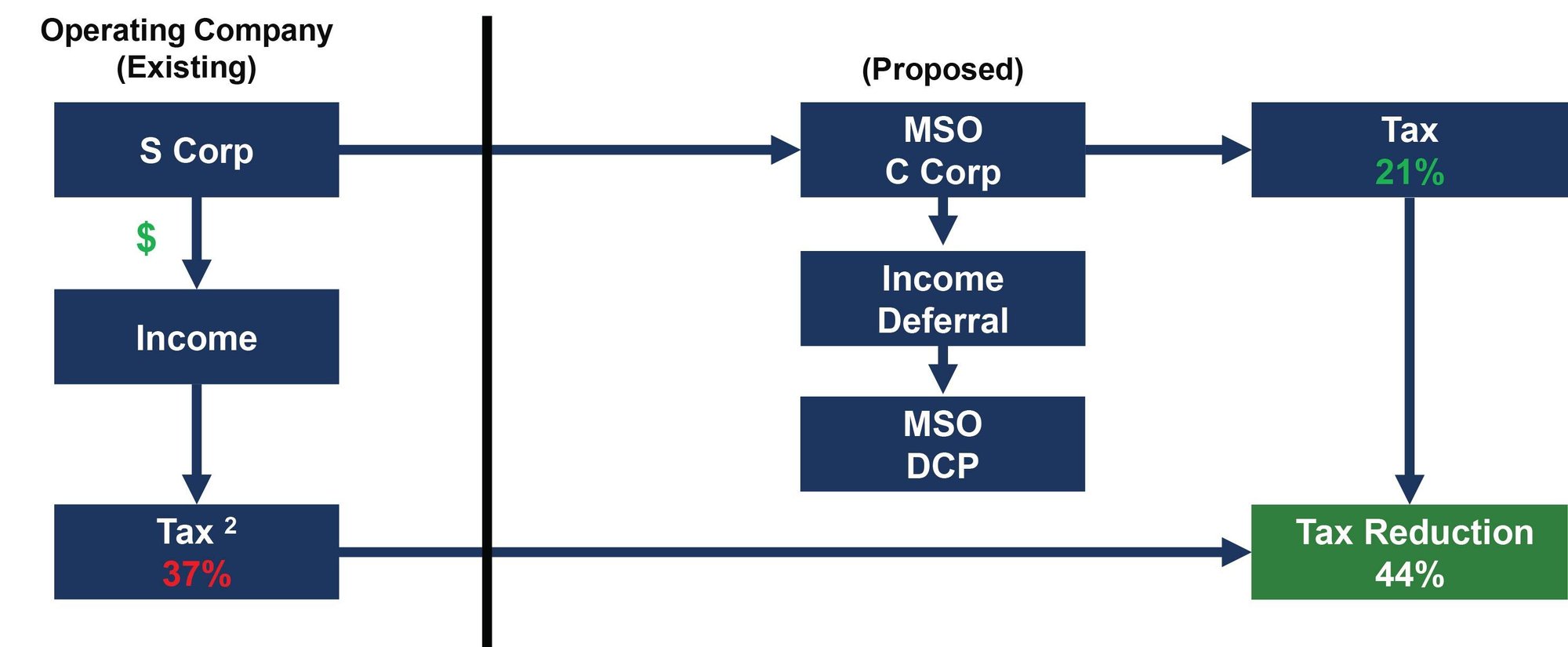

Solution for S Corp and C Corp majority shareholders to defer income.

Provide your contact information you would like to learn more about!

An innovative solution for a traditional challenge.

Majority owned S Corporations and C Corporations can establish an MSO (Majority Shareholder Owned) deferral plan to better manage corporate operations and provide the business owner with the ability to defer income and accumulate wealth on a tax-favored basis.

How It Works:

1 Fee amounts must be determined by a third party in accordance with the rules and regulations governing MSOs.

2 S Corp tax rate may be higher after accounting for state-specific tax rates.

PTE vs. MSO C Corp - Cumulative After-Tax Benefit

The graphic below illustrates the economic advantage of the MSO Deferral Plan over a PTE investing after-tax income into taxable securities. Assumes a 37% PTE tax rate and 3.8% Net Investment Income Tax (NIIT) on taxable securities, 21% MSO C Corp tax rate, compensation deferral of $2 million annually for 7 years, 7% rate of return and a 15-year accumulation period.

The 105% advantage is the difference between the cumulative after-tax benefits of each strategy based on the financial assumptions applied over the combined 15-year accumulation and 15-year payout periods.