Long-Term Incentive Plan

The advantage of implementing an LTIP.

Provide your contact information you would like to learn more about!

How LTIP's can help retain top performers...

Implementing a Long-Term Incentive Plan (LTIP) can provide a worthwhile benefit for a company’s key talent, eliminating the cost associated with losing an executive.

%20Graphic.jpg)

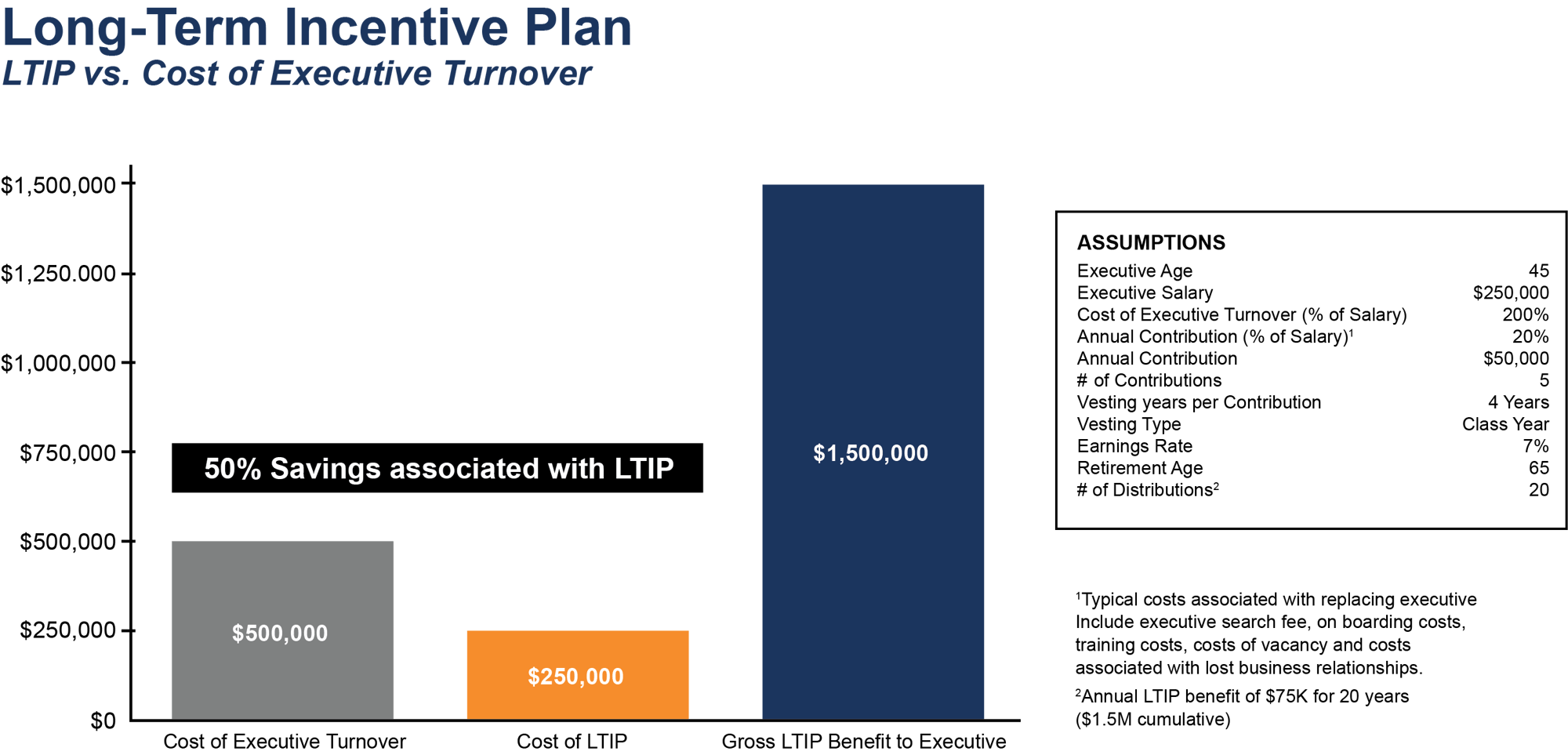

The chart below illustrates how an LTIP, which is a deferred compensation plan, can save your company roughly 50% by retaining just one key member of your team, as well as the potential benefit to the employer.

Additionally, a Profit Interest Plan (PIP) is an equity-based compensation LTIP strategy option for consideration. PIPs are designed similar to private equity incentive plans and are based on reaching company planned KPIs.

A Stock Appreciation Rights (SAR) Plan is another LTIP strategy where instead of granting outright shares, key employees receive a cash or stock bonus equal to the increase in the value of a company’s stock over a specified period. Employees receive the value of the appreciation, and the payouts can be designed either while employed based on years of service and/or a retirement age. The payout amounts are typically a percentage of the vested SAR amount.

SARs can be layered alongside, or in place of, other LTIP vehicles such as PIPs, letting you tailor rewards to company KPIs while keeping top talent focused on long-term value creation.

Hypothetical example(s) are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment for actual clients.