Split-Dollar Plan Overview

Obtaining life insurance on an executive.

Provide your contact information you would like to learn more about!

Retaining key talent with life insurance.

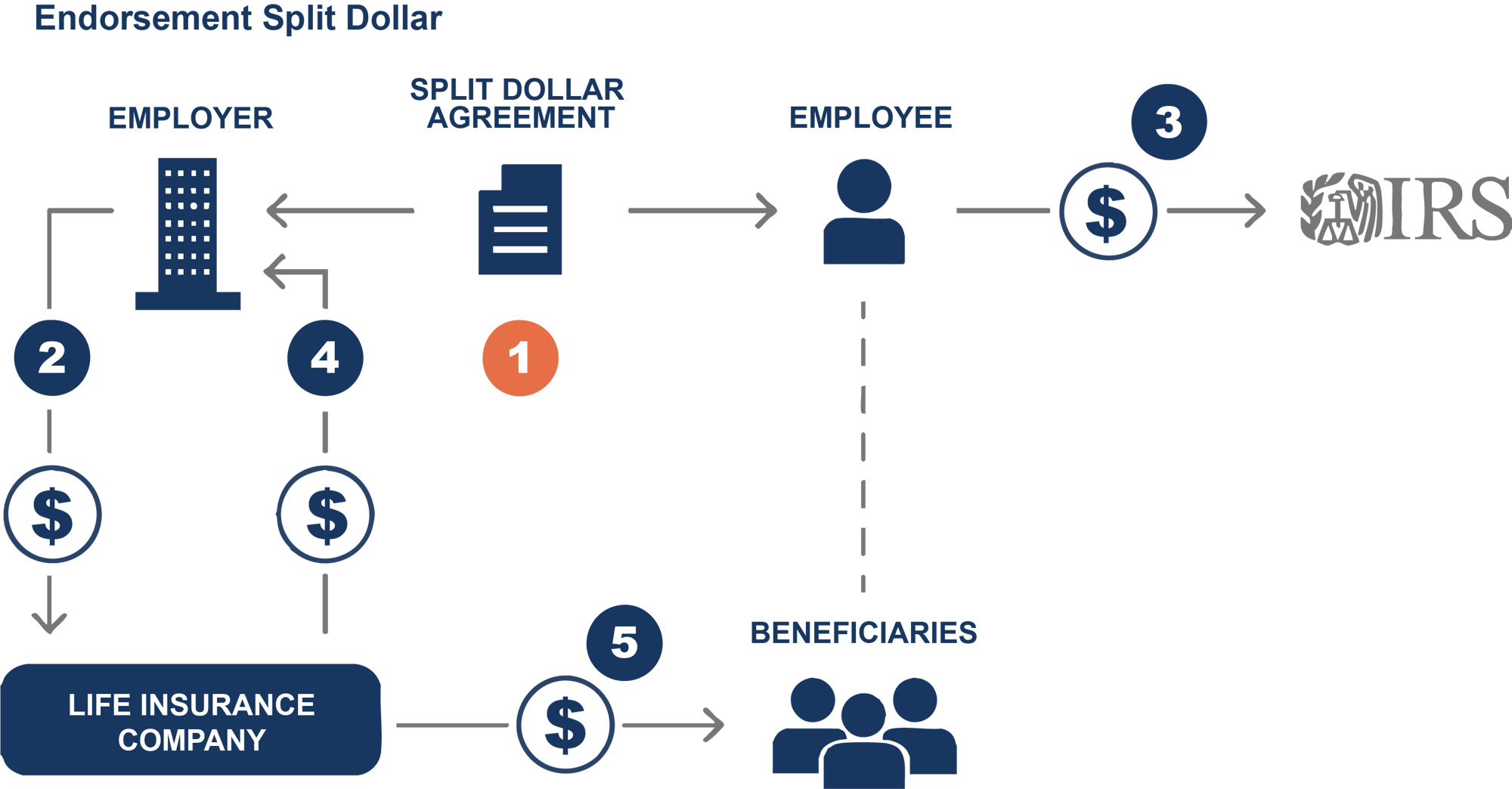

To help illustrate how a Split-Dollar strategy works, Mezrah Consulting created the following example:

Mezrah Consulting has proposed the utilization of a split-dollar group term carve-out plan (replace all group term life insurance over $50k) whereby a 2x salary life insurance benefit is provided to the participants by way of an endorsement split-dollar arrangement.

-

The employer establishes a split-dollar agreement with the employee. The employer owns the policy and agrees to endorse a portion of the death benefit to the employee’s beneficiaries.

-

The employer pays the premiums to the insurance company on the life of the employee.

-

The employee is taxed on the value of the “economic benefit” of the policy, equal to the value of a term life policy with an equivalent death benefit.

-

If the employee passes away - the employer receives the death benefit at least equal to the policy’s cash value.

-

The employee’s beneficiaries receive the employee’s portion of the death benefit, federal income tax free.

The net premium expense is the cost associated with the remaining $50,000 of group term coverage per participant.

Note: Assumes 80 participants, average executive age of 52, average executive salary of $250,000, current group term life insurance (GTLI) cost per $1,000 of benefit of $0.062,

proposed Split-Dollar benefit amount of 2x salary less $50,000 of group term, 3% annual growth on group term life annual premiums and a 26.5% corporate tax rate.

Hypothetical results are for illustrative purposes only and are not intended to represent the past or future performance of any specific product.