Controlled Bonus Plan

The advantage of using life insurance to fund executive benefits by establishing a CBP.

Provide your contact information you would like to learn more about!

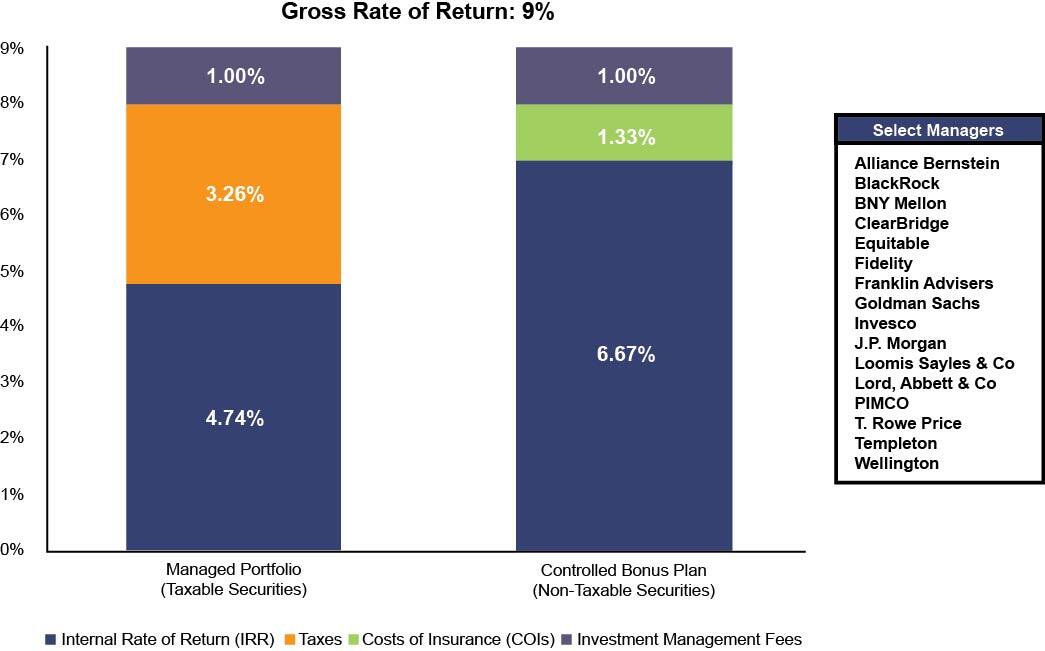

The chart below helps illustrate how establishing a CBP as an executive benefit plan tool can provide an effective off-balance sheet option:

Performance Comparison: Controlled Bonus Plan vs. Taxable Securities*

*Hypothetical example. For illustrative purposes only. Actual results will vary.

Note: Based on a male, age 45, preferred non-tobacco underwriting, 7 annual contributions of $250K,

40.8% tax rate used for taxable securities and based on a year 20 performance. Taxable securities assumes 100% annual portfolio turnover.