iCOLI

Is iCOLI the right investment structure for your company?

Provide your contact information you would like to learn more about!

The Advantages of iCOLI

Insurance carriers are always pursuing higher net yields, which has resulted in many companies allocating significant positions to iCOLI assets. These assets offer tax advantages, access to higher yielding investments and the ability to minimize capital charges and reserve requirements.

Lower RBC Treatment

- Capital can be freed up and used elsewhere effectively improving earnings.

- Risk-Based Capital (RBC) Charges – The repositioning of assets from “Invested Assets” to “Other Assets” creates favorable capital impact with RBC relief. RBC charges are 0% for life/health carriers and 5% for property/casualty carriers regardless of the assets that comprise the iCOLI’s investment portfolio.

Improved Investment Earnings

- Tax-free investment yields that generate strong ROAs and ROEs if held to maturity (i.e., death of insured)

- Ability to reallocate and diversify assets among a variety of money managers and pursue various investment strategies without tax cost

- Transparency of all fees, expenses, and sources of return; minimal, to zero, frontend loads and surrender charges

Customized Investment Portfolios

- Provides access to many institutional money managers and a wide range of investment options such as fixed-income, equities and alternatives

- Ability to create an asset allocation strategy that reflects targeted riskreturn objectives and/or mirrors existing portfolio

Favorable Accounting

- The ability to mark-to-market allows for all realized/unrealized gains to flow to the income statement

- Cash Surrender Value of the policy is an admitted asset on the balance sheet of the insurance company

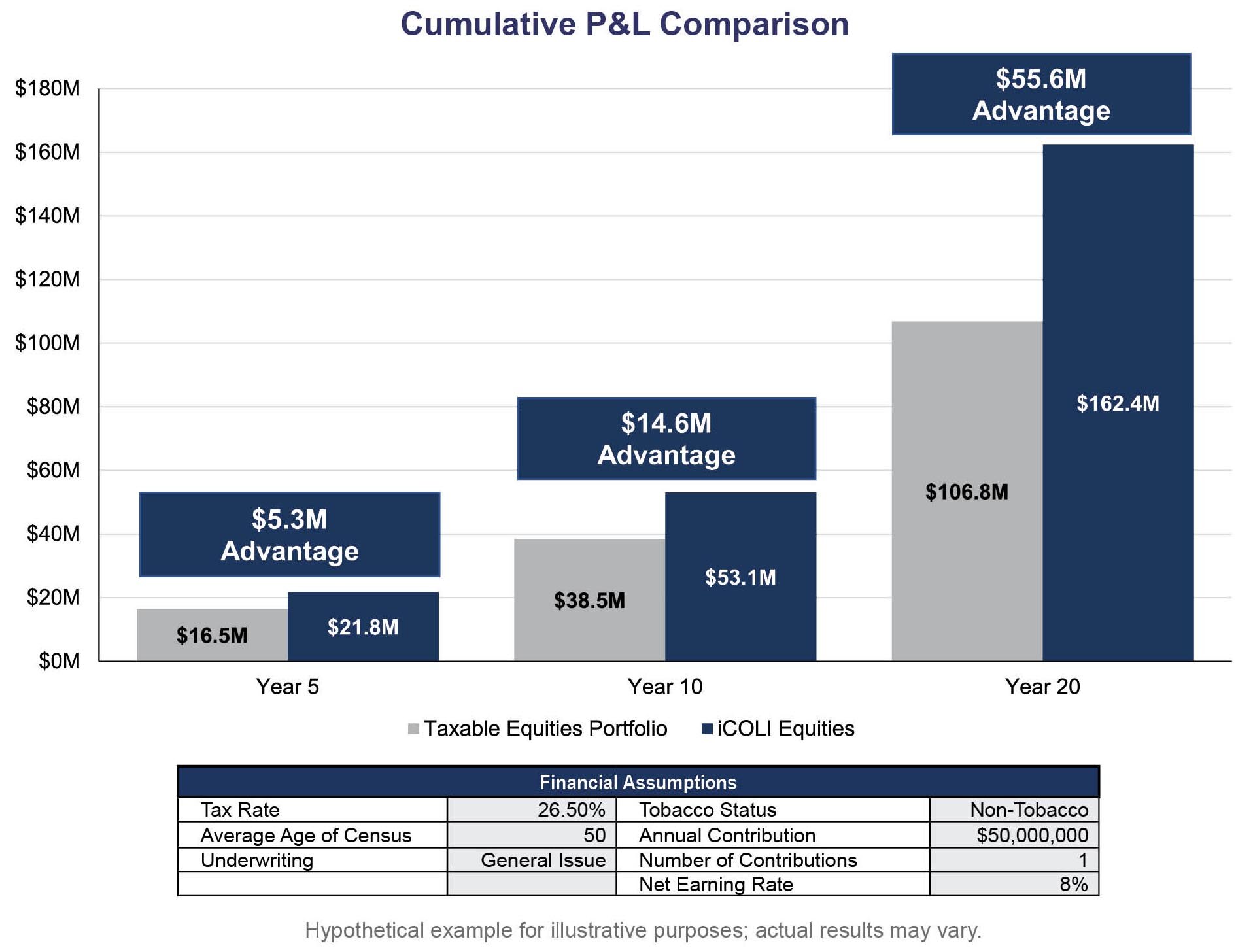

The chart below captures the advantages of investing $50 million in iCOLI as compared to taxable securities over various time frames.