Domestic Captive Insurance

Create of an insurance company that can be owned by an individual...

Provide your contact information you would like to learn more about!

Exploring the creation of an insurance company that can be owned by an individual or corporation can create value from a business risk, tax, and economic perspective. Utilizing a structure with integrity, identifying business risks, selecting a favorable jurisdiction and identifying the right team are all paramount.

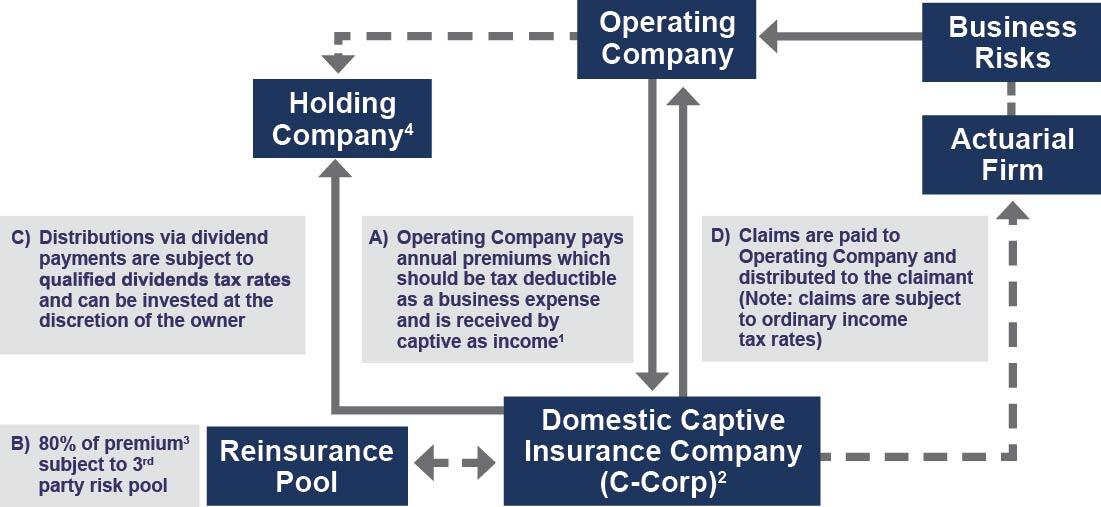

Plan Mechanics

1 Based on IRC 831(b), premium income up to $2.35 million is not taxable to the domestic captive insurance company.

2 May have multiple captives if business risks and premiums are justifiable, and the captives are not owned by the same control group.

3 Total captive assets are subject to 3rd party claims in a policy year where one is participating in the risk pool.

4 A wholly owned holding company can be utilized to own the captive. Note: captive would still be part of the operating company’s balance sheet.