Estate Preservation Plan

A Plan that creates an asset outside of an executive’s estate.

Provide your contact information you would like to learn more about!

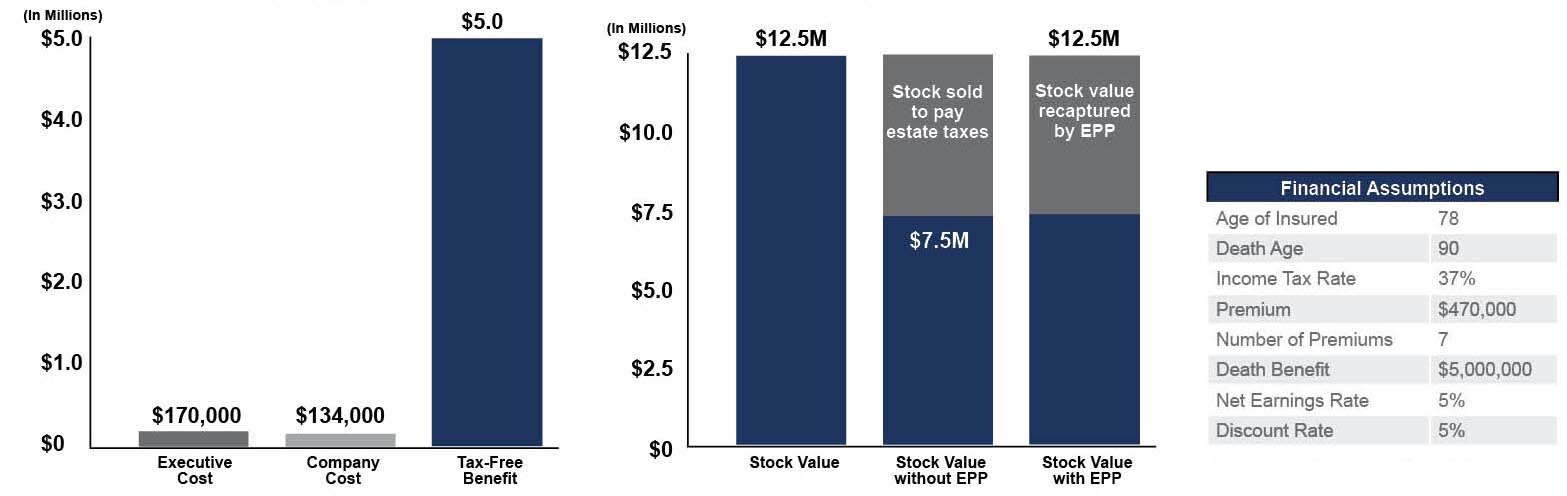

The charts below illustrate a hypothetical example of the costs, benefits and stock preservation of an estate preservation plan: The corporation acquires a life insurance asset with relatively little earnings impact, and the beneficiary is the executive’s irrevocable life insurance trust.

Estate Preservation Plan Benefits & Costs

Estate Preservation Plan Costs and Benefits Life of Plan

Stock Value

Type of product used: Survivorship VUL. For illustrative purposes only. Actual results will vary.

These hypothetical example(s) are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment for actual clients.

Life insurance death benefit claims are subject to the financial strength of the issuing carrier. Policy issuance is dependent on medical and financial underwriting requirements of the carrier.

The investment return and principal value of the variable life policy are not guaranteed. Variable life sub-accounts fluctuate with changes in market conditions. The principal may be worth more or less than the original amount invested when the policy is surrendered.

Variable life insurance is sold by prospectus. Please consider the investment objectives, risks, charges, expenses, and your need for death-benefit coverage carefully before investing. The prospectus, which contains this and other information about the variable life policy and the underlying investment options, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.