Using Deferred Compensation Plans to Obtain Merger and Acquisition Advantages

March 31, 2021 (republished)

When people think of deferred compensation plans (DCP), several words typically come to mind – “income deferral,” “saving for retirement,” “tax-deferred growth,” “tax-deferred earnings,” and, perhaps, even the words “non-qualified.” Deferring income and accumulating wealth on a tax-favored basis is traditionally thought of as making elections to defer salary, bonuses, incentive compensation, and even equity forms of compensation (e.g. RSUs and PSUs) in order to warehouse cash, pre-tax for some future use.

While all of the above is accurate and focuses on the benefits and value to the executive participant, there are uses of a deferred compensation plan that can provide a company with a planning tool of its own. We are not talking about the company deferring its own income but rather leveraging the integrity of the deferred compensation plan structure to provide the company with a competitive advantage in mergers and acquisitions (M&A). Adapting the use of one’s deferred compensation plan as part of a company’s overall M&A strategy can be a significant differentiator in getting a deal to close for both the acquiring company and the seller.

The ideal M&A profile of a company where a DCP can be utilized is typically a privately owned entity with few majority shareholders. This is prevalent in industries that are consolidating and where companies are effectively being rolled up into larger institutions. The size of the company or the amount of the purchase price is not relevant. The most common fact patterns where deferred compensation plans can be effective in an M&A transaction are as follows:

-

The seller’s purchase price and company value are higher than the buyer are willing to pay.

-

The seller is tax sensitive and does not want a lump sum payout.

-

The seller is not interested in a taxable earn out.

-

The buyer would like to integrate performance into the purchase price by establishing performance milestones that would justify the company’s purchase price.

-

The buyer would like to retain the senior management team of the seller after an acquisition.

-

The buyer is looking for a means to better compete against competitors’ bids.

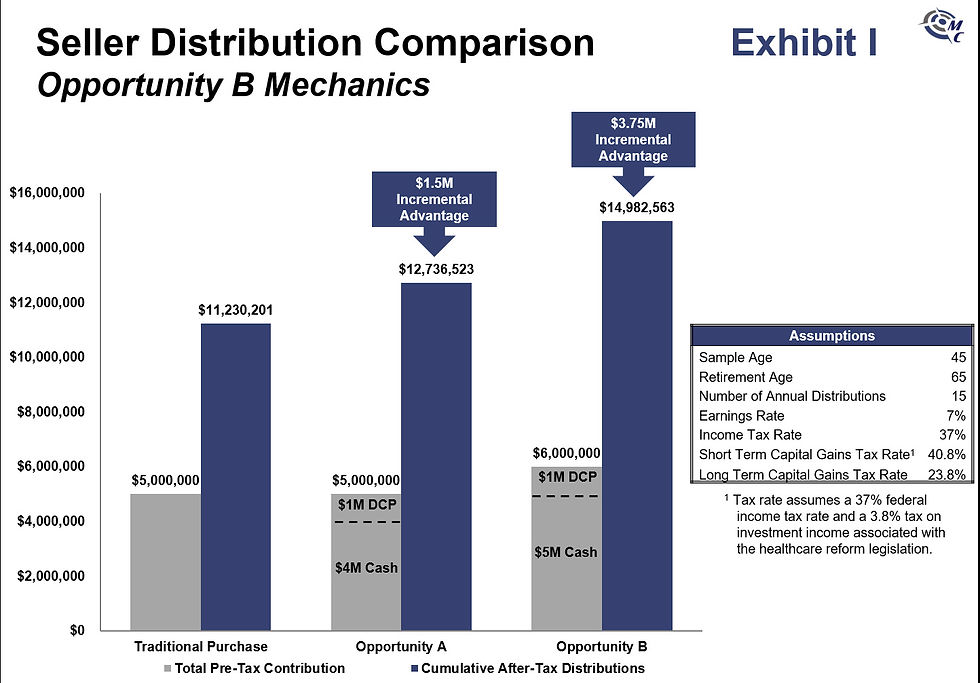

The key to any acquisition is finding common ground and, more importantly, a balance that satisfies everyone’s interests. The seller wants the highest price with the least tax cost. The buyer wants to pay the lowest price on a tax-favored basis or, alternatively, pay an amount (or part of the total purchase price) based on some measure of future performance. A DCP can be utilized to create this dynamic balance in finding a win-win for both the buyer and the seller. Rather than being limited by traditional purchase options, the DCP offers opportunities that can include more favorable economics. Opportunities A and B are examples that illustrate this idea.

Opportunity A:

-

Seller desires a purchase price of $5 million.

-

Buyer values the business at $4 million.

-

Buyer offers seller $4 million with an additional $1 million in a DCP to meet seller’s asking requirements.

-

$1 million in DCP vests over three years based on performance and certain milestones being achieved.

-

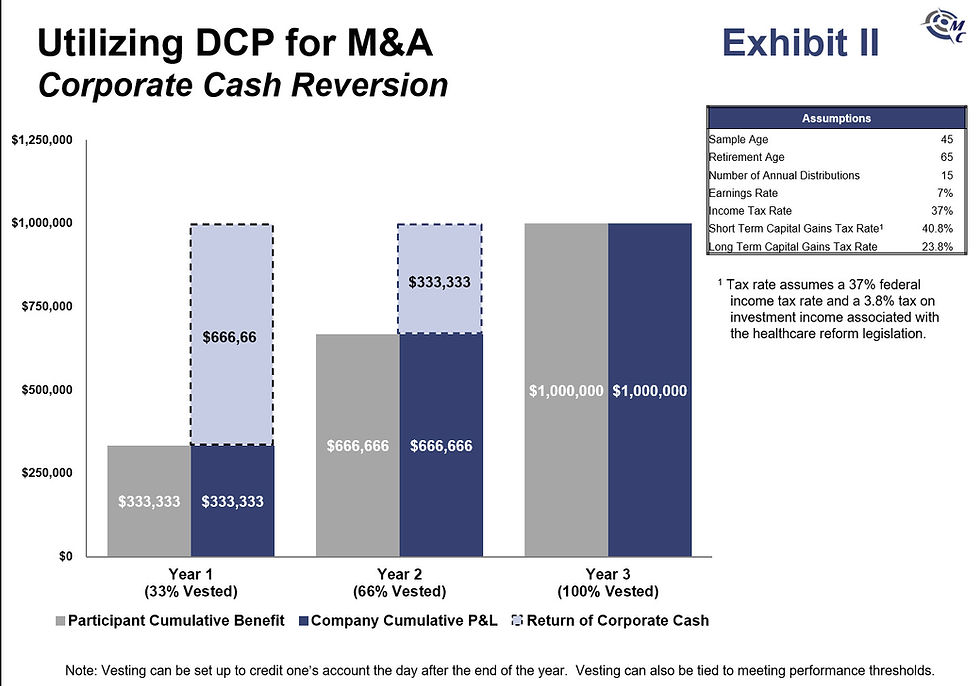

Buyer economics are such that, if performance metrics are not met and milestones are not achieved, then only $4 million is paid for the business. (note: The $1 million contribution into the DCP would revert back to the buyer; see Exhibit II.)

-

If performance metrics and milestones are achieved, the buyer will effectively be able to pay out 20% of the sale price on a tax-deductible basis.

-

Seller will get 20% of their sale price tax-deferred, which creates more favorable economics for the seller, i.e. a higher purchase price with $1 million growing tax-deferred.

Opportunity B:

-

Seller’s asking price of $5 million is met by a competitor of the buyer.

-

Buyer offers $6 million to get the deal done to effectively block a competitor’s bid.

-

Buyer’s offer of $6 million includes a $1 million contribution to a DCP.

-

Buyer ties the DCP contribution to years of service of the seller’s participants as a means of retaining talent.

-

Economics to the seller are more favorable: higher purchase price overall with $1 million growing tax deferred.

The graphic below compares for the Seller the advantages of a DCP assuming cumulative after-tax distributions associated with Opportunities A and B as compared to a traditional all-cash purchase.

The graphic on the following page compares the participants’ cumulative benefit to the buyer’s cumulative P&L impact associated with a $1 million DCP contribution and assumes a three-year vesting schedule (based on meeting performance metrics, years of service, and other milestones). The return of corporate cash represents the refund to the buyer if the acquired company does not meet the vesting criteria requirements (note: vesting can require years of service, performance, or both).

If M&A is an important part of your business plan and is vital to achieving your financial goals, then you should consider the use of a DCP to give you that competitive acquisition edge! As illustrated, it can be advantageous for both the buyer and the seller. Other non-traditional uses of DCPs that should also be considered are the creation of a deferred signing bonus and the deferral of severance benefits.

Contributions from deferring signing bonuses and severance benefits can vest over a period of time and can include both a service and performance element. Deferred signing bonuses are ideal when you are looking to make an executive whole for benefits that they might be giving up by leaving their existing company or if you just want your company to be more competitive in luring the executive away. Having the ability to make planning decisions ahead of time in this way could save your new executive unnecessary taxes in addition to providing another opportunity for them to accumulate wealth on a pre-tax basis.

If you already have a deferred compensation plan in place, it is important to understand the integrity of the structure and its many uses beyond just thinking about it as a way to defer traditional forms of compensation. If you don’t have a deferred compensation plan and your business strategy revolves around actively looking to acquire other companies, we would encourage you to contact Mezrah Consulting to explore the implementation of a deferred compensation plan and to better understand its cash flow costs, P&L impact, and strategic advantages.

More Information

For more information call (813) 367-1111 and ask for Sales, or email consulting@mezrahconsulting.com. A team member will reach out to you shortly!

Who We Are

Mezrah Consulting, based in Tampa, Florida, is a national executive benefits and compensation consulting firm specializing in plans for sizable publicly traded and

privately held companies. For more than 30 years, we have focused on the design, funding, implementation, securitization and administration of nonqualified executive benefit programs, and have advised more than 300 companies throughout the U.S.

As a knowledge-based and strategy-driven company, we offer clients highly creative

and innovative solutions by uncovering value and recognizing risks that other firms typically do not see. Custom nonqualified benefit plans are administered through our affiliate mapbenefits®, a proprietary cloud-based plan technology platform that provides enterprise plan administration for nonqualified plans, including reporting and functionality for plan participants and plan sponsors.