MSO Management: A Structured Approach to Setting and Supporting MSO Fees

Introduction

Mezrah Consulting has partnered with Guardian Tax Consultants (“Guardian”) to provide

Management Services Organization (“MSO”) services which include MSO setup, compliance

and fee determination.

Guardian is regarded as an industry authority, and the following outlines their thoughtful, and

diligent approach to determining MSO fees in a manner consistent with IRS code provisions.

What We Do

Purpose

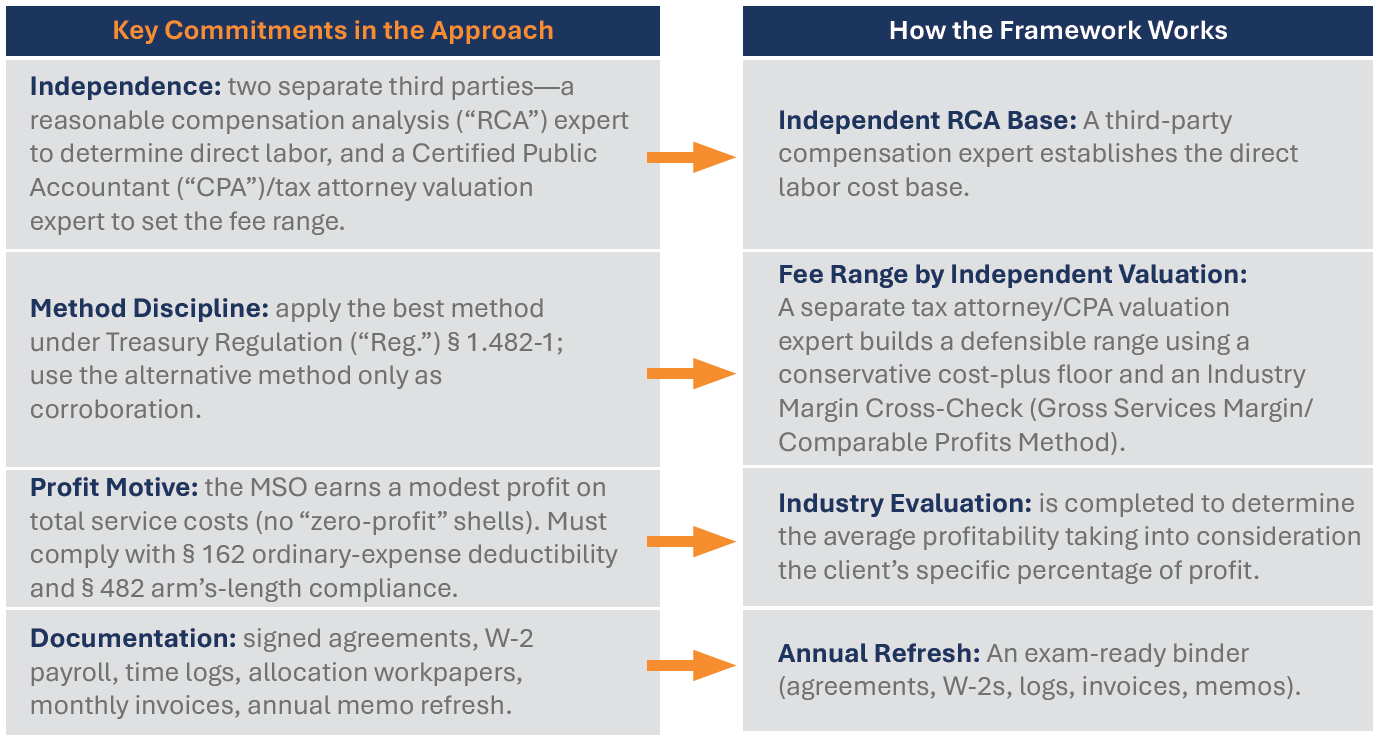

A management fee range for an MSO should be rooted in services actually provided and properly documented so it is deductible under Internal Revenue Code (“IRC”) Section (“§”) 162 and arm’s-length under IRC § 482.

What This Approach Solves

Related-party management fees can be challenged when they appear arbitrary, duplicative, or

untethered to services. This framework addresses those potential pitfalls by (i) building the fee

from an independently established labor base, (ii) using recognized IRC § 482 methods to define a defensible range instead of a single number, and (iii) maintaining a contemporaneous, exam-ready file each year.

The Method – Steps and Rule

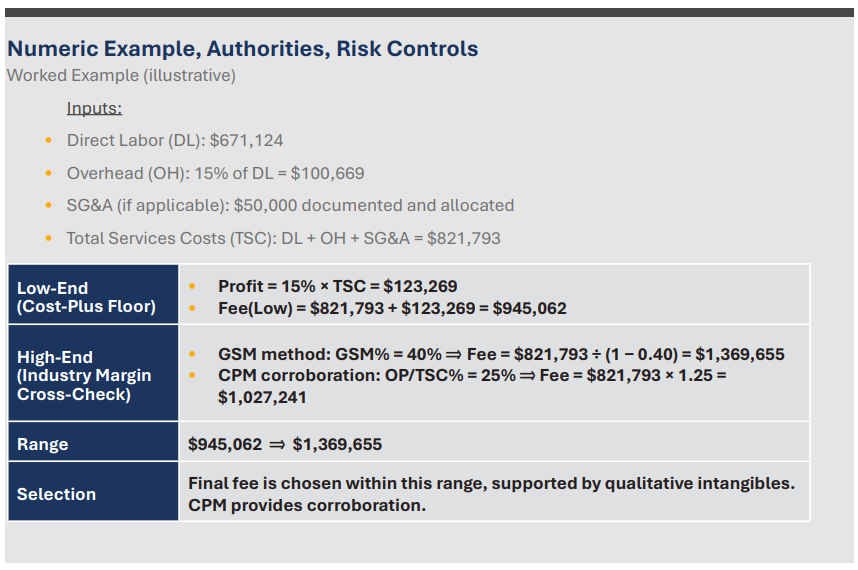

Step 1 – Build Total Services Costs (“TSC”)

-

Direct Labor (“DL”): An independent RCA determination is obtained by role, hours,

geography, and proficiency. -

Overhead (“OH”): Indirect costs allocated per Reg. § 1.482‑9(j),(k) using

reasonable drivers (e.g., payroll/time basis, headcount, square footage). -

TSC = DL + OH.

Note: In practice, OH allocations are based on documented cost drivers. The 15%

in the numeric example is illustrative only.

Step 2 – Adjust and Establish the Cost-Plus Floor

- A – Include SG&A if Applicable

If selling, general and administrative (“SG&A”) expenses (e.g., Human Resources,

IT, office administration) are incurred centrally in the MSO and not already

captured in OH, they may be added to TSC. These costs must be documented

and reasonably allocated across all benefiting operating companies (per Reg. §

1.482‑9(b)(7)). Exclude general shareholder or financing costs not tied to services.

Once included, recalculate both the Cost‑Plus floor and the Industry Margin

Cross‑Check using the adjusted TSC to avoid double counting. - B – Set the Low‑End (Floor) with Cost‑Plus

- Profit = 15% × TSC (adjusted if SG&A included).

- Fee (Low1) = TSC + Profit.

Clarification: No safe harbor exists for 15%. A 15% profit on TSC is adopted here as a

policy floor to evidence profit motive under IRC § 162 and falls within the interquartile

range (10–25%) commonly observed in IRS APA and industry databases. OH and

SG&A must be calculated and supported, not assumed.

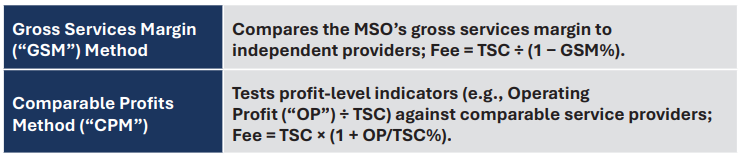

Step 3 – Set the High‑End (Ceiling) with Industry Margin Cross‑Check

Recognized IRC § 482 methods are applied to establish the high-end of the fee range, with

one method chosen as the best method and the other used as corroboration:

Comparables are sourced from industry benchmarking services (e.g., CSI Market) and

independent profitability databases used in IRC § 482 analyses. The chosen method

must be justified as the best method under Reg. § 1.482-1(c) based on data quality,

comparability, and reliability.

1The “low” part of the fee—the Cost-Plus floor—represents the minimum defensible, profit-motivated amount the MSO must charge to be recognized as a legitimate trade or business under IRC § 162 and compliant with § 482.

Step 4 – Consider Intangibles in Fee Determination

When labor is shifted into the MSO, certain intangibles move with it and form part of the

service value. These may include personal guarantees of debt, key relationships and

know‑how, tenure and continuity of leadership or critical employees, and operational

responsibility and risk assumed by the MSO. These factors are evaluated qualitatively—

they do not create additional fees beyond the cost-plus floor or industry ceiling, but explain

why a final fee may reasonably sit above the floor within the established range.

Step 5 – Multi‑Operating Company (“OpCo”) Allocation

A single total fee is computed, then allocated consistently across OpCos per Reg. § 1.482-9(b)

(7), based on reasonably anticipated benefits.

Step 6 – Annual Refresh

This process is refreshed annually: Reasonable compensation analysis is re-run, NAICS/

industry margins are re-benchmarked, three-year OpCo results are updated, and a new

memo is issued. Agreements, W-2s, logs, and invoices are kept current to preserve

contemporaneity and exam readiness.

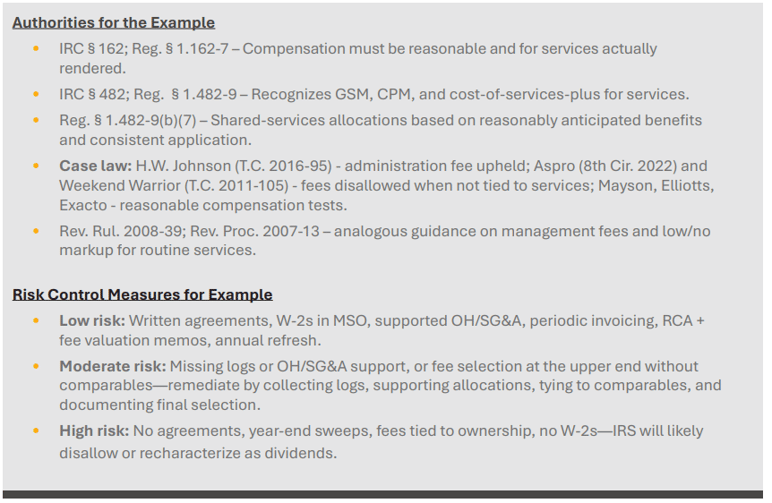

Audit Playbook and Implementation Checklist

How we position this in an exam

- Open with the binder: agreements, org chart, MSO scope, pricing method memo

(best‑method analysis). - Walk the agent through TSC construction (DL, OH, SG&A) with allocation workpapers

and drivers. - Show the RCA report (third‑party), then the fee‑range memo (separate expert).

- Demonstrate the annual refresh cadence and periodic invoicing (no year‑end sweeps).

- Walk through GSM/CPM data sources and reliability; explain why the chosen method is the best method.

- Close with the allocation basis across OpCos — consistent, documented, and benefit‑based.

Implementation checklist (internal)

- Engage RCA expert; collect role profiles, hours, locations.

- Compile indirect cost pools and choose OH drivers; confirm if any SG&A should be included.

- Engage valuation/tax expert for best‑method analysis and fee‑range memo.

- Draft/update management services agreement; define scope, pricing, allocation basis, and invoicing cadence.

- Establish time logging and monthly invoicing; centralize workpapers (binder).

- Calendar annual refresh; assign owners and due dates.