What Motivates Executives to Be Their Best— And What Actually Retains Them

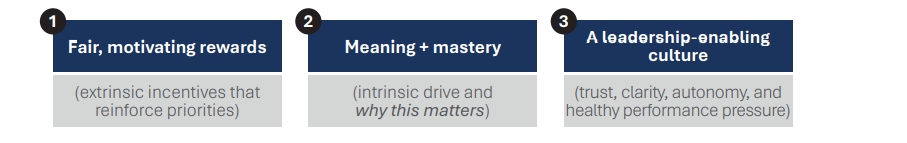

Executive retention is often discussed as a single-solution issue: “pay them more,” “give them equity,” “create a cohesive work environment.” In practice, high-performing executives stay (and perform) when three key pillars of the workplace work together:

When any one of the above referenced systems break, you get the common failure mode: high pay+ low commitment (the executive is “retained” on paper but disengaged) or high purpose + poor rewards (the executive’s commitment becomes vulnerable to competitive offers).

When meaning, rewards, and culture are properly aligned, conditions are created where executive motivation becomes sustainable rather than situational.

There are seven components of executive retention that break down the above solutions into their most actionable components, revealing the specific ways organizations can energize executive performance and reduce retention risk.

Together, they explain not just why executives engage—but why they remain.

1) The Driving Forces: What Motivates Executives to Be “The Best”

A. Executives tend to be motivated by a blend of intrinsic drivers:

-

- Purpose / Meaning: belief that the work matters and is worth the personal cost.

- Autonomy: real decision rights, not “responsibility without authority.”

- Mastery / Growth: new problems, bigger scope, learning curves.

- Reputation / Status: peer benchmarking, board visibility, “scoreboard” outcomes.

- Legacy: building something that outlasts their tenure.

Executives aren’t immune to these dynamics; if anything, they feel them more acutely because the job is high-pressure and identity-consuming. When purpose erodes, compensation becomes the only reason to stay—and that is fragile.

Two reports come to mind when examining the intrinsic drivers:

-

- Great Place To Work analyzed 1.3M+ employee surveys (2024–2025) and found meaningful work is the top retention driver. (Great Place To Work®)

- Gartner found only 46% of employees feel supported in their career growth; and their research highlights that aligning work to what people value personally increases intent to stay(their press release cites “4.1x more likely to stay” when purpose is elevated through values alignment). (Gartner)

B. Extrinsic drivers: compensation and benefits as “scoreboard + security”

Compensation accomplishes two things for executives:

-

Scoreboard: “Am I winning here vs. peers and my own expectations?”

-

Security: “Is my family’s financial plan protected while I take risk?”

That’s why compensation isn’t just money, it’s feedback.

The market reinforces this: public-company executive pay has been pushed upward by equity values and incentive design, and the incentive portion is a major driver of increases. (Harvard Law Forum)

-

-

Between 2023 and 2024, median CEO total compensation increased (e.g., 8.1% in the S&P 500 in the cited analysis), with notable increases in equity / incentive components. (Harvard Law Forum)

-

This reveals a critical reality: executives often expect a meaningful portion of wealth creation to come from long-term performance and equity. If your program design doesn’t provide a credible path to win long-term, you will lose them to places that do.

Understanding what motivates executives at this level is only the starting point; the more difficult question is how those drivers are sustained over time—and why they sometimes diminish even in roles that once felt deeply compelling.

2) How Passion is Found (or Lost): The “Earned Purpose” Model

How passion is built (or eroded): the “earned purpose” sequence

Executive passion is rarely discovered as a latent trait. It is typically earned through a reinforcing loop in which structure, authority, and signal alignment compound over time:

➔ Clarity

The executive understands what winning looks like, why it matters, and how success will be judged. Strategy, priorities, and decision rights are sufficiently coherent that the executive can make tradeoffs with confidence rather than guesswork.

➔ Progress

With clarity in place, the executive has the authority, resources, and organizational support required to translate intent into visible forward motion. Progress here is not effort—it is the ability to move the system and produce outcomes that would not have happened otherwise.

➔ Recognition

This progress is explicitly acknowledged by the CEO, board, and relevant stakeholders. Outcomes are correctly attributed, signals are consistent, and success is reinforced rather than diluted by shifting expectations or opaque evaluation criteria.

➔ Identity

Repeated, recognized progress solidifies self-concept. The executive starts to internalize the role: “This is what I do. This is the value I create.” The work stops feeling transactional and begins to feel personally owned.

➔ Commitment

Once this corporate identity is established, the executive becomes invested more deeply: emotionally, cognitively, and behaviorally. They take longer-term bets, tolerate short-term friction, and anchor themselves to the organization’s future.

Career development and growth support matter because they sustain this loop. Gartner research shows a significant gap between growth expectations and the support leaders actually receive, increasing disengagement and attrition risk. (Gartner)

How the loop breaks

Passion is lost when this sequence is disrupted—most commonly at progress or recognition:

-

At progress, bureaucracy, political interference, or chronic underinvestment prevent the executive from converting responsibility into results.

-

At recognition, inconsistent feedback, moving goalposts, or opaque compensation decisions sever the link between outcomes and reward.

When clarity exists but progress stalls—or progress occurs without recognition—the loop collapses. Even highly capable, intrinsically motivated executives begin to disengage.

This is where compensation design takes on disproportionate strategic importance: it is not merely a retention tool, but a structural signal that reinforces the earned purpose loop.

3) Are Executives Retained by Incentives, Equity, Long-Term Incentive Plans (“LTIPs”), Deferred Compensation, SERPs—or All of It?

All the above are retention strategies, but they focus on different attributes.

Here’s the breakdown:

A. Annual incentive (bonus): Focus and Pace

-

-

Best for near-term execution, operating cadence, driving priorities this year

-

Risk: can overweight short-term optimization unless paired with LTIPs and strong culture

-

B. Equity (ownership): Alignment and Identity

-

-

Best for cultivating an “ownership mindset” strategy through multi-year vesting

-

Risk: if the stock becomes the only motivator, leaders may become volatility-sensitive rather than mission-driven

-

C. LTIPs (Performance Share Units (PSUs), Performance Cash, Options): Multi-Year Discipline

-

-

Best for aligning strategy to long-term outcomes and discouraging near-term extraction.

-

Risk: Plan design matters; external scrutiny increases when targets are routinely re-baselined or revised mid-cycle (proxy advisors and investors watch this closely). (Reuters)

-

D. Deferred Compensation and SERPs: Security + Time Horizon

-

-

Best for creating staying power, smoothing retirement timing, enabling risk-taking without personal financial panic

-

Often works as “golden handcuffs,” but the better framing is “golden seatbelts”: you keep executives secured enough to drive fast.

-

This aligns with what many boards are doing: using long-term vehicles and retirement-oriented benefits to reduce unwanted turnover and succession risk.

Each compensation vehicle reinforces a different behavior and time horizon. As a result, retention outcomes ultimately depend on whether these tools are aligned with the culture executives are expected to operate within.

4) Culture: The Retention Multiplier Executives Don’t Stop Caring About

Compensation plans can attract and retain on paper, but culture determines whether executives are positioned to deliver sustained enterprise value.

A. Culture’s measurable role in why people exit organizations:

Even outside the executive tier, the top reasons people quit are culture-linked:

-

-

SHRM (citing iHire’s 2024 talent retention survey of 2,000+ workers/employers) reports top reasons employees left included toxic/negative work environment (32.4%), poor company leadership (30.3%), and dissatisfaction with manager (27.7%), while unsatisfactory pay ranked sixth (20.5%). (SHRM)

-

The same source notes 83.4% valued a positive work environment, and many would trade compensation for balance, culture, and flexibility. (SHRM)

-

Executives may have higher pay, but they are still human: if the environment becomes political, incoherent, or ethically uncomfortable, their reputational risk rises—and money becomes less persuasive.

B. Culture erosion is a board-level risk now:

-

-

Gartner’s 2025 research warns foundational pillars of culture have been eroding since 2022,with only approximately 26–27% of employees reporting positive cultural indicators, and just 16.6% perceiving the environment as innovative. (Gartner)

-

Why this matters for executive retention is evident: strong leaders want a culture where high performance is possible without constant friction. If culture feels stagnant, slow, or distrustful, top executives start to believe their legacy will be capped.

-

Culture is not a backdrop to retention decisions but rather a force that actively shapes them. This raises the question of which cultural environments high-performing executives are most willing to commit to long term.

5) What Culture is Most Embraced by Executives—And Why

High-performing executives most often gravitate toward cultures with:

-

High standards + high trust (candor, accountability, no drama)

-

Speed with guardrails (empowered decision-making + clear risk limits)

-

Meritocracy with transparency (how decisions get made is knowable)

-

Real investment (tools, talent, budget match the ambition)

-

Psychological safety for truth-telling (bad news travels fast)

These aren’t “nice-to-haves.” They directly affect an executive’s ability to deliver outcomes that their incentives require.

However, these cultural attributes only endure when they are reinforced, not contradicted, by how executives are evaluated, rewarded, and held accountable.

6) Where Culture and Compensation Intersect (And How to Design it Right)

Culture and compensation aren’t separate systems. Compensation is one of the strongest signals of “what we truly value.”

A. There are three key design principles when connecting culture and compensation:

1. Line-of-sight:

Executives stay motivated when they can see how decisions and tradeoffs connect to outcomes and rewards.

2. Fairness + transparency:

Executives don’t need every detail, but they do require confidence that compensation is principled and consistently applied.

3. Values in metrics:

A growing trend is embedding strategic/values outcomes (e.g., leadership, talent, risk, sustainability) into incentive scorecards, but it must be measurable enough to be credible, or you invite backlash. Investor/proxy scrutiny often centers on whether targets are adjusted downward or opaque. (Reuters)

B. How to “wire” culture into compensation design:

Annual incentives:

-

-

-

Include operating outcomes plus a limited set of culture-critical goals (e.g., leadership bench strength, retention of key roles, customer outcomes, risk/compliance).

-

Guardrail: avoid vague “CEO discretion” provisions unless tightly governed.

-

-

Long-term incentives (PSUs / performance-based plans):

-

-

-

Use three-year measures that reflect long-term value creation and discourage short-term moves.

-

Add modifiers only where the company has clear data credibility.

-

-

Deferred compensation / SERPs:

-

-

-

Pair benefits with leadership expectations: succession readiness, mentorship, continuity planning.

-

Positions the plan as an investment in stewardship, not just handcuffs.

-

-

C. “Total rewards” meets “total experience”

Executives tend to be especially sensitive to ESG (environmental, societal, governance)/risk because it intersects with brand and reputation—another retention lever that pure cash can’t replace.

When compensation and culture are aligned, retention becomes far less reactive, allowing organizations to move from isolated plan design to a more integrated, durable approach.

7) The Practical Retention Playbook

If your goal is to retain executives and keep them performing at their best, the most effective approach is:

-

Compensation that is competitive and structured to win long-term: credible LTIP opportunity; clear performance measures; retention hooks where appropriate.

-

Role design that creates autonomy + visible impact: decision rights, resources, and a mandate that matches the title.

-

Culture that reduces friction and increases trust: speed, candor, accountability, psychological safety.

-

A growth story for the executive: new scope, succession pathways, board exposure, skill building.

-

Security benefits that allow risk-taking: deferred compensation, supplemental retirement, financial planning support.

Executive retention is not driven by any single mechanism. It is the compounded result of credible long-term rewards, real operating authority, and a culture that enables leaders to perform and build something that lasts. When these systems reinforce each other, sustained performance and retention follow.