The True Cost of Losing an Executive

Finding and retaining your best team is critical to your business’s success. There are obvious costs of losing a key member of your leadership team, but do you know the full impact of the hidden costs?

The real costs of losing an executive can reach an astounding 300% or more of their annual salary.

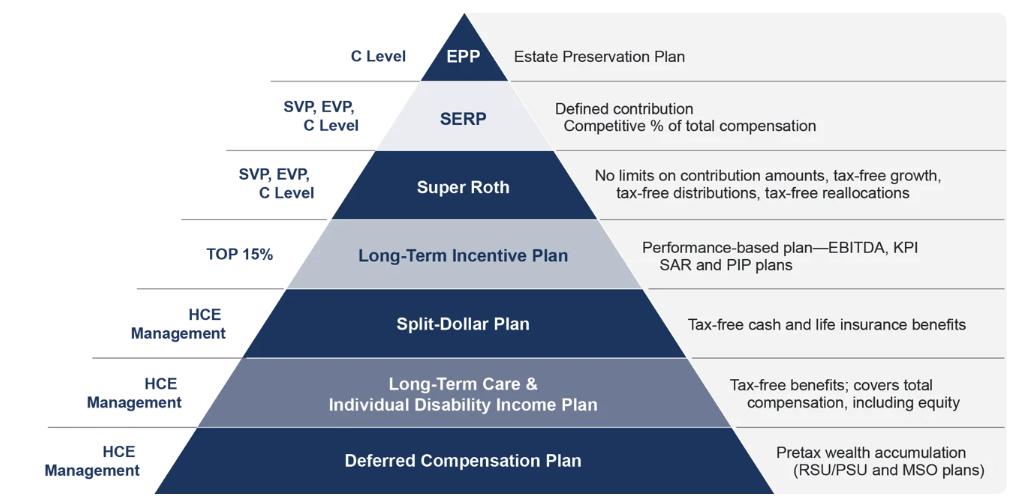

That's why your executive benefits and compensation package should be a strategic focus. Partner with a team that works hard to design plans to meet both your company’s and your executives’ financial goals.

Find out what’s possible for your business.