Deferred Compensation Plan Asset / Liability Reconciliation Managing Profit and Loss (P&L)

1) Timing of Funding

2) Funding Projections

3) Timing of Payroll Deferrals

4) Timing of Payouts

5) Timing of Crediting Interest to a Participant

6) Participant Ability to Asset Allocate

7) Asset Structure Costs

Timing of Funding

The key to reducing the P&L risk of the plan is timing. There are two components to timing when investments are made: 1) the timing of the funding itself and 2) the timing of the movement of money into appropriate investments.

There are several funding options, including funding in arrears, funding upfront (annually, quarterly, or monthly), and funding every pay period. Funding in arrears is almost a guarantee that a company will incur additional expenses unless the market rate of interest is negative over the same time period. Alternatively, funding every pay period creates the most errors in terms of timing and the increase in administrative work needed. Funding upfront clearly provides for the tightest management of assets against liabilities as the dollars can be better controlled and moved as needed based on deferrals.

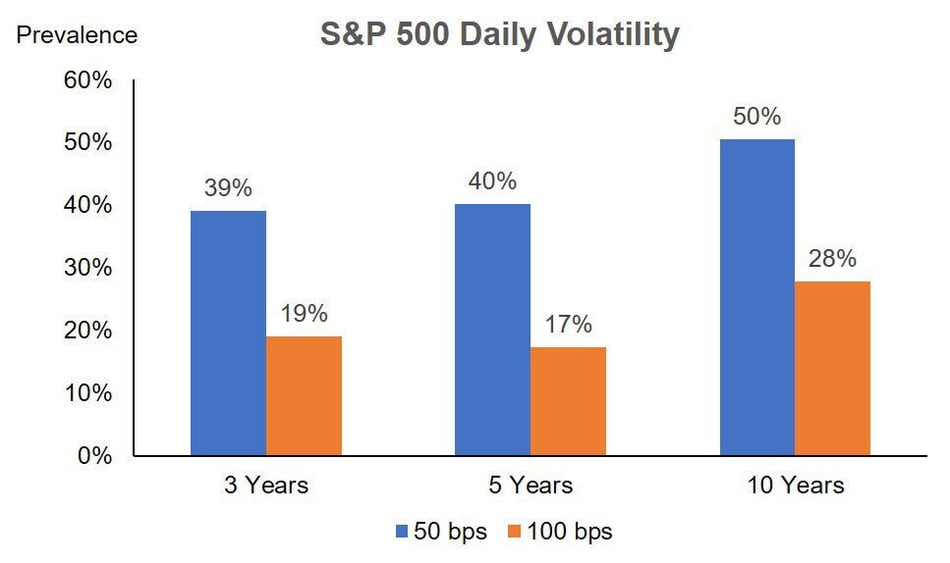

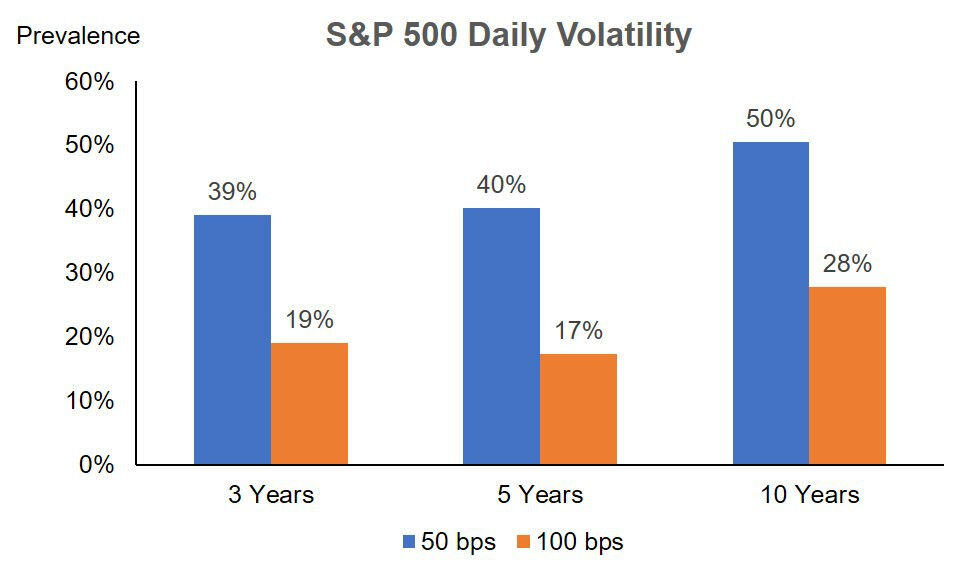

While one may optimize the plan by addressing its funding aspect, the timing on when dollars are moved into the specified investment funds is important to keep in mind. If dollars are not moved from cash into appropriate investments in concert with when participants are credited, then balance sheet mismatching can occur. Moving the money even a day or two later than planned can prove to be onerous because of market swings. For example, the graphic below shows that, over 3, 5, and 10 years, there were 297, 505, and 1,270 days respectively in which the market moved more than 50 basis points; it also indicates that there were 144, 217, and 699 days when the market moved more than 100 basis points. This level of volatility highlights the importance of making sure that interest credited is always in line with asset earnings.

Source: S&P 500 Daily Returns

Funding Projections

While funding upfront is the most conservative and prudent method for eliminating P&L impact, (assuming the right processes are in place for moving the money and the plan design accommodates appropriate participant crediting of accounts), the amounts funded upfront are purely based on projections of anticipated deferrals. These projections can be impacted by new plan participants, increased bonus and commission amounts, and unanticipated increases in salary with resultant increases in deferral amounts (as opposed to decreases). Unanticipated increases can leave big gaps in asset amounts as compared to the liability. While these gaps can be made up, they can promote potential expense in an up market. It is important to always anticipate the compensation variables noted and, when possible, stay ahead of them and proactively allocate additional funding when needed.

Timing of Payroll Deferrals

As each payroll occurs and dollars are deferred, participants’ accounts are increased, and interest can immediately be earned on the new deferral dollars. If interest is immediately earned but assets have not yet been moved or funding has not occurred in concert with the new deferrals, P&L impact can occur.

When payouts are made, whether from corporate cash or plan assets, funding projections, or funding amounts, the relationship between asset and liability can be impacted. It is important to understand and anticipate future projected payouts when considering asset/liability management. Accommodating material payouts is even more important as they can bring about substantial changes and drive unanticipated financial consequences.

Timing of Crediting Interest to a Participant

Crediting interest in line with the movement of assets is essential if one is to appropriately manage the P&L of the deferred compensation plan. Typically, interest is credited on the day that deferrals are made to the plan. This immediate crediting of interest does not leave much time for the plan administrator to allocate the assets in a timely manner. If a trustee is involved, there may be other delays in moving assets into the appropriate investment funds.

Ideally, crediting of a participant’s deferrals should not begin until the assets are in a position to be moved. Moreover, the plan document should dictate when interest is credited. Administratively, some thought should be given to these processes to accommodate for potential delays with language that notes that interest will be credited “as soon as administratively feasible” so that no unnecessary financial stress is put on the plan. As with payrolls, funding, and payouts, timing is everything!

Participant Ability to Asset Allocate

Providing the participant with the opportunity to asset allocate at any time and immediately crediting interest based on the new investment allocations is yet another variable that can impact the expense of the plan. This approach does not provide for timely alignment of assets with liability and will undoubtedly create unnecessary expense. As an alternative, a company should consider allowing for reallocation elections to be made at any time but not transact on those elections until the next pay period. This allows for appropriate timing with the other scheduled deferrals (and processes) and a crediting of interest that can be effectuated with reduced risk of expense to the company.

Asset Structure Costs

It is important to understand that there are costs associated with any asset structure. These costs typically can be assessed daily, monthly, or quarterly. Costs can include investment management fees, costs of insurance (assumes COLI funding), and taxes. Measuring these costs and understanding their impact and timing is essential. Costs can create underfunded positions putting the assets at a disadvantage during an up market. In this situation, there are fewer assets earning interest than interest credited to the liability.

Executive Summary

It should go without saying that the financial management of a deferred compensation plan is ever- moving and requires a significant investment of discipline, dedication to process, and an understanding of all the variables. Companies should not expect their plan assets to always be equal to their liabilities. With that said, they should be close; earnings on assets should be commensurate with earnings credited to the liability. The highest probability of accomplishing this asset/liability matching is to partner with a consulting firm that controls both the asset and the liability. Working with a firm that administers the deferred compensation plan and the in-formal funding in concert with one another and providing all of the necessary accounting and asset/liability reconciliation is essential. We internally at Mezrah Consulting practice completing a detailed monthly reconciliation which is paramount in identifying and addressing any meaningful variances or discrepancies, so they do not persist. Constantly evaluating and improving processes, obtaining a detailed reconciliation, and amending the plan document as needed should prove to be a worthwhile expedition in better plan management.

More Information

For more information call (813) 367-1111 and ask for Sales, or email consulting@mezrahconsulting.com. A team member will reach out to you shortly!

Who We AreMezrah Consulting, based in Tampa, Florida, is a national executive benefits and compensation consulting firm specializing in plans for sizable publicly traded and privately held companies. For more than 30 years, we have focused on the design, funding, implementation, securitization and administration of nonqualified executive benefit programs, and have advised more than 300 companies throughout the U.S.

As a knowledge-based and strategy-driven company, we offer clients highly creative

and innovative solutions by uncovering value and recognizing risks that other firms typically do not see. Custom nonqualified benefit plans are administered through our affiliate mapbenefits®, a proprietary cloud-based plan technology platform that provides enterprise plan administration for nonqualified plans, including reporting and functionality for plan participants and plan sponsors.