MC Briefcase: Best Allocation of Corporate Tax Savings

US corporations will be receiving a significant injection of cash by way of tax savings due to the recent Trump Tax legislation. As we are all aware, corporate tax rates have been dropped to 21%, the lowest corporate tax rate in the history of the United States since the early 1940’s. It is also important to note that there are 44 states with state income taxes ranging from 4% (North Carolina) to 12% (Iowa).

How Would the Tax Proceeds Be Utilized?

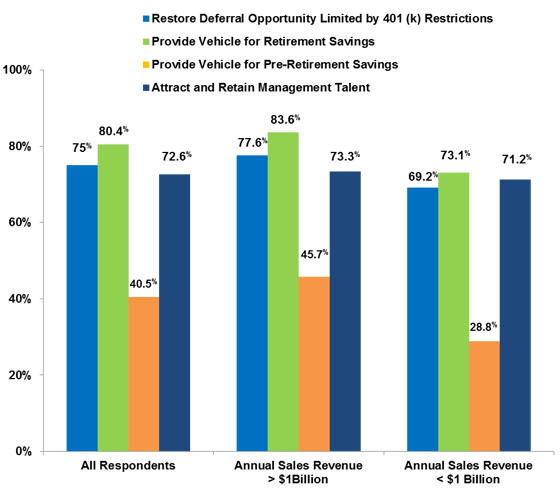

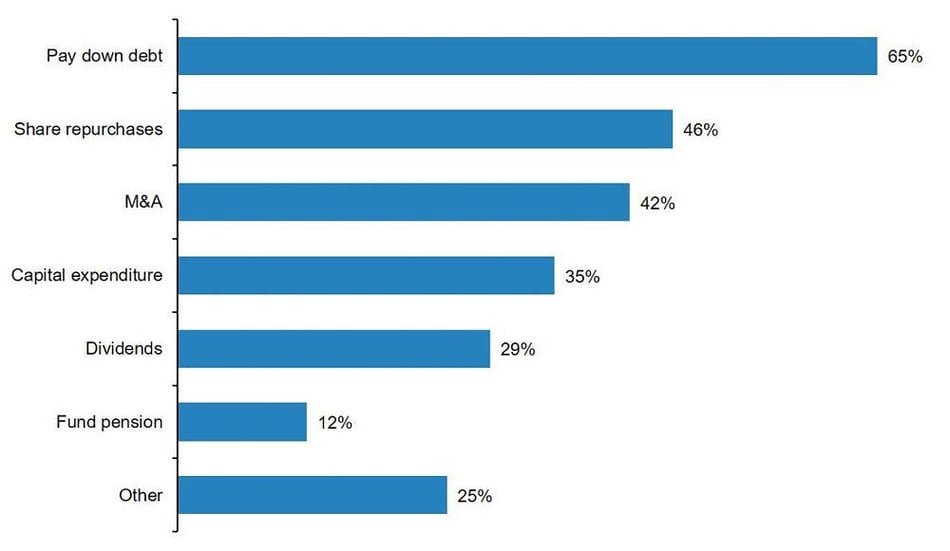

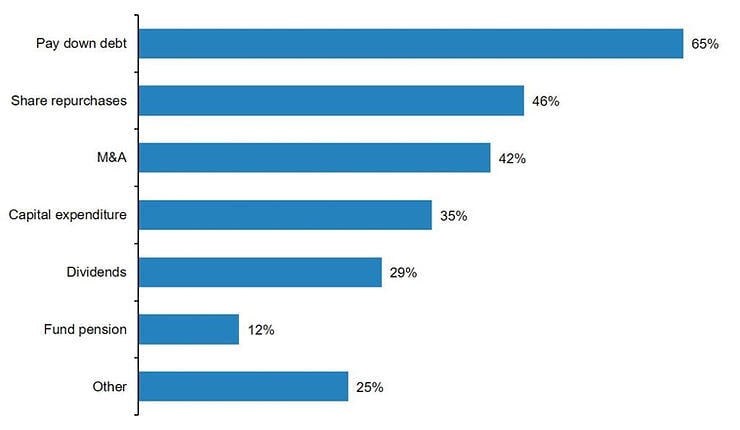

Source: 2017 BofAML Corporate Risk Management Survey

Where will corporations deploy and allocate these dollars? There are a variety of options, of course, including share repurchases, dividends, M&A, and paying down debt. The conversation is all about where are the company and its shareholders going to get the most value. Another conversation taking place is the corporate tax rate savings not being permanent, a new Congress or President could effectively enact legislation that drives corporate tax rates back up. Setting a precedent for spending and allocating dollars can often send the wrong message to the capital markets and, more importantly, to employees and executives of those corporations. It is paramount that a company’s strategy be thoughtful and strategic when allocating these dollars.

With this in mind, here are two thoughts:

1) What if the dollars allocated targeted strategic business units and the people that drive the profitability of those businesses?

2) What if the company addressed its balance sheet and repaired any mismatches that may actually drive a different behavior from key executives while improving P&L?

While there are many options for uses of the tax savings and, arguably, dollars should be allocated to more than just one initiative, there are two that should be considered based on the thoughts noted above.

Compensation and Benefits

Increasing wages has a sense of permanency to it and can provide executives with unreasonable expectations moving forward. If tax rates increase in the future is the company going to decrease wages and would that be acceptable to the executive team? More than likely the answer is no and such actions could lead the company into a long-term adverse financial position, not to mention human resource challenges.

Mezrah Consulting’s suggestion is to consider repositioning the cash to provide a long-term incentive based on company performance. This can be achieved by utilizing a non-qualified deferred compensation plan (NDCP). The contribution can be based on years of service and/or corporate performance and can vest over time. The vesting can even be based on achieving certain milestones (e.g. service and performance).

This plan can be incredibly impactful, in line with corporate and shareholder interests, and does not have the air of permanency associated with it. If the company and the individual executives perform, the dollars allocated will be deserved. Creating an additional performance incentive for executives and key management to drive profitability as well as shareholder value is clearly a win-win. It also does not necessarily require a significant allocation of capital depending on how many executives you want to impact. Other things to consider when designing the Long-Term Incentive Plan are as follows:

-

The company will just be repositioning cash on their balance sheet to the deferred compensation plan

-

There is no P&L impact associated with the plan until one vests and performance metrics are achieved

-

Vesting can be based on a variety of elements including years of service, company performance, or individual performance

-

The company is not committing dollars to the plan every year unless performance thresholds are met

-

There is no permanent aspect to the plan like a salary increase

-

This executive benefit is an impactful way to motivate executives and create a tool for attracting other executive talent

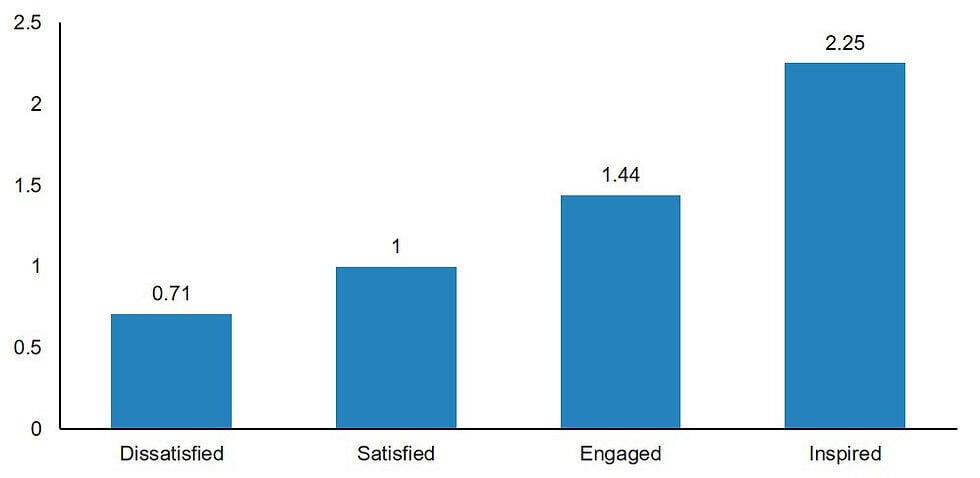

How Does Executive Behavior Drive Productive Output?

Note: 300 senior executives were surveyed and asked to assess, based on their impressions of employee output, the relative productivity of dissatisfied, satisfied, engaged and inspired employees, where satisfied employees serving as the benchmark. For example, inspired employees (based on this scale) deliver an output equivalent to 2.25 satisfied employees.

While a long-term incentive plan or supplemental executive retirement plan is an ideal way to better attract and retain talent, there are additional ways to allocate tax savings and reposition cash on the balance sheet without P&L impact. These other executive benefits can include split dollar plans and executive long-term care plans. The eligibility for these plans can be based on years of service or title.

Balance Sheet Repair

For companies that have unfunded or under-funded executive benefit plans, this is an opportunity to provide balance sheet parity. These are plans where the liabilities do not have corresponding offsetting assets. As a result, P&L impact is created every year and an executive’s benefits become further away from being secured. This can be the case with a non-qualified deferred compensation plan or a supplemental executive retirement plan (SERP).

Fact patterns that may drive a need to fully fund are:

1) A deferred compensation plan was put in place that provided participants with the ability to select from a variety of investment funds but no offsetting assets were secured as the company did not think the impact of the plan was going to be material. 5 years later there is over $20 million in liabilities creating an annual $2 million hit to P&L on average.

2) A deferred compensation plan that credited a fixed guaranteed rate was implemented. Participation was initially low until the company merged with an entity of equal size. At that point, the plan was amended to allow for a variety of payout options and investment choices were expanded to include market rates of return. The plan liability doubled in 2 years and the P&L impact of the plan became a material item.

3) A legacy defined benefit SERP was partially funded and has not been funded in line with other corporate pension plans. In addition, a grantor trust was not established so the benefits are not secure given a change in control, a change of heart, or from the company’s inability to pay plan benefits.

Funding executive benefit plans can provide the company with reduced P&L impact, the ability to recover the cash flow costs of the plan and provide benefit security for the plan participants. This not only can improve the financial position of the company but, moreover, can have a positive psychological impact on the executive team by setting aside cash in trust to better secure benefit payments.

The most intriguing aspect of utilizing the tax savings for either one of these two initiatives is the company’s decision to do so will be incredibly impactful from a financial and personal executive perspective. Most importantly, the value and impact of this decision can be accomplished with a relatively low amount of capital creating a company’s return on investment that is both tangible and material.

What better way to make use of these dollars than to benefit those that are driving the strategic vision and profitability of the company. The implications can be immeasurable in terms of shareholder value and executive goodwill.

More Information

For more information call (813) 367-1111 and ask for Sales, or email consulting@mezrahconsulting.com. A team member will reach out to you shortly!

Who We Are

Mezrah Consulting, based in Tampa, Florida, is a national executive benefits and compensation consulting firm specializing in plans for sizable publicly traded and

privately held companies. For more than 30 years, we have focused on the design, funding, implementation, securitization and administration of nonqualified executive benefit programs, and have advised more than 300 companies throughout the U.S.

As a knowledge-based and strategy-driven company, we offer clients highly creative

and innovative solutions by uncovering value and recognizing risks that other firms typically do not see. Custom nonqualified benefit plans are administered through our affiliate mapbenefits®, a proprietary cloud-based plan technology platform that provides enterprise plan administration for nonqualified plans, including reporting and functionality for plan participants and plan sponsors.