Resurgence of Executive Benefits – Attracting and Retaining Executive Talent

Since the Tax Reform Act of 1986 corporations have looked to non-qualified plans to allow themselves to better attract and retain executive talent and provide for retirement and wealth accumulation plans beyond the limitations imposed by the federal government as it relates to qualified pension plans (e.g. 401(k) plans, profit sharing plans, etc.). Non-qualified plans are employer-sponsored plans that are not subject to the rules, regulations, and limitations inherent in qualified pension plans. As a result, there are effectively no limitations on what executives can defer, or what corporations can provide in terms of supplemental retirement income. The only requirement is that companies only make eligible highly compensated (i.e. compensation of $120,000 or more) and/or management employees. In addition, these plans also have an element of substantial risk of forfeiture, which means that the benefits of the plan are general obligations of the company. Moreover, any assets set aside to informally fund these plans are general assets of the corporation and are subject to claims of creditors.

Given the recent increase in income tax rates (note: top income tax bracket is now 40.5% not including state tax) there has been a resurgence in the participation in and offering of deferred compensation plans. In addition, with executive perks being closely monitored, companies have been looking for executive benefit opportunities that have little to no impact on the company’s profit and loss statement.

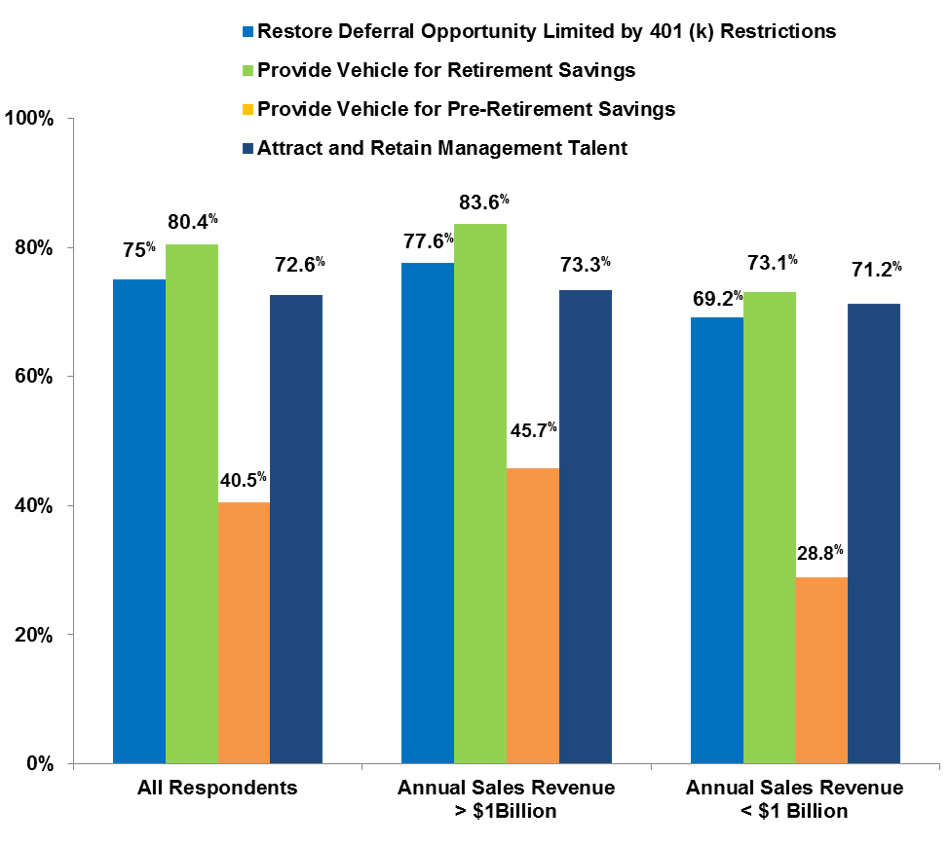

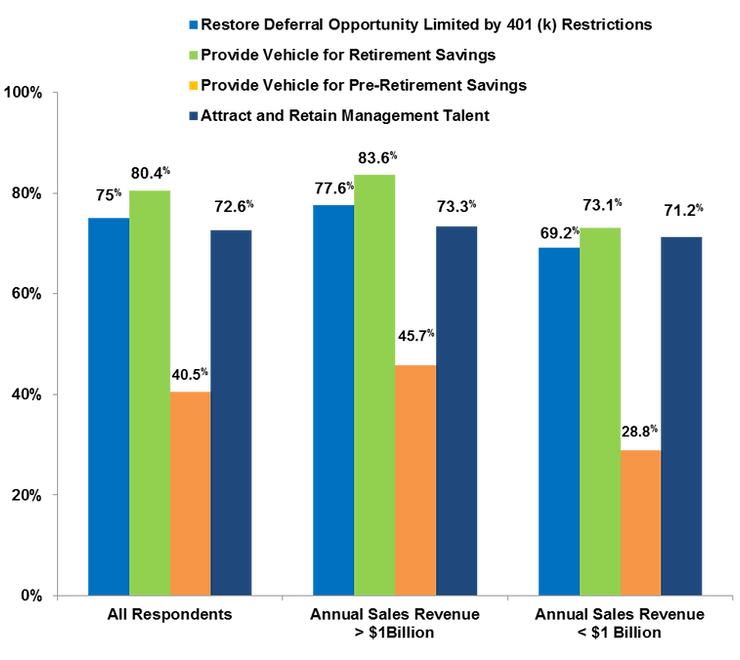

The below graphic illustrates why companies look to implement executive benefit plans. While the rationale may vary, the common theme is the idea that highly compensated employees have been reversely discriminated resulting in an executive’s inability to retire with the same percentage of their income as a non-highly compensated employee.

Source: 2008 PLAN SPONSOR NQDC Survey

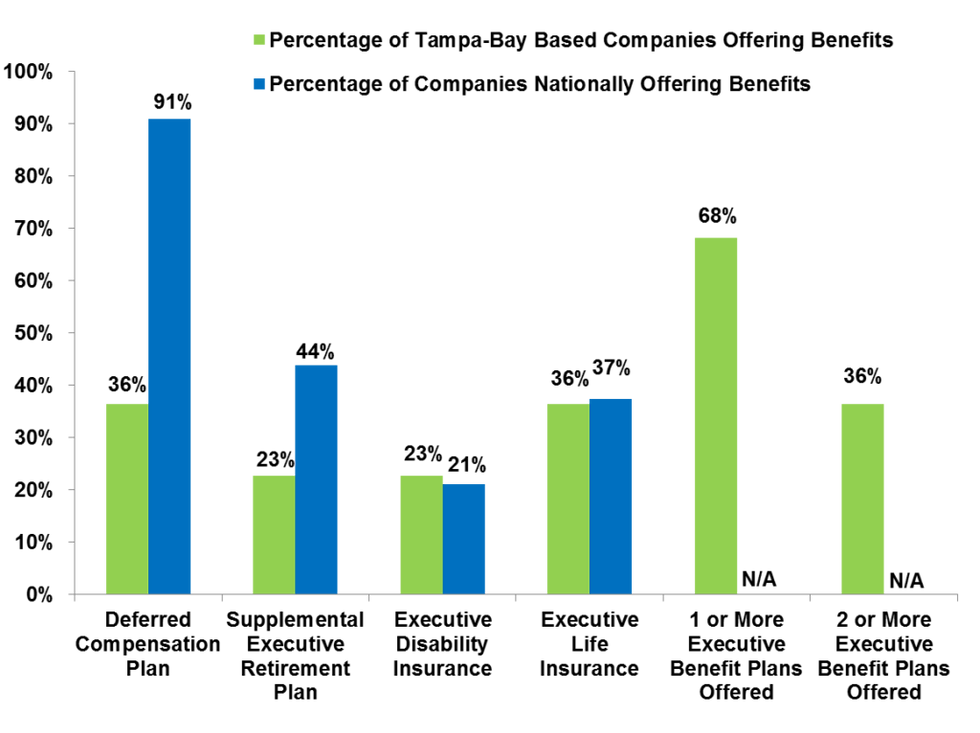

The survey provided takes into consideration small, medium and large companies in Tampa Bay and focuses on a variety of executive benefit plans including deferred compensation plans, supplemental executive retirement plans (SERP), executive life insurance and executive disability income plans.

In summary, deferred compensation plans allow a select group of executives to voluntarily defer their income (salary, bonus, commissions and incentive compensation) to a future date and accumulate wealth on a tax-favored basis. The dollars deferred can be structured to be paid at a specified date, upon separation of service or a retirement.

SERP’s can take the form of a defined contribution plan or defined benefit plan whose benefits are paid for by the company and paid to the executive at retirement age.

An executive life insurance plan is a plan whereby the company pays a premium for a life insurance policy whose death benefit is typically equal to some multiple of the executive’s salary (e.g. 3x salary). These benefits can be structured to be income tax-free when paid to the beneficiary of the participant.

An executive disability income plan is a plan typically provided as a supplement to an existing group long term disability plan to provide supplemental monthly income to the executive upon not being able to perform the material duties of their own occupation. Monthly benefit amounts are often increased, plan provisions are enhanced, and additional forms of compensation are often covered including equity forms of compensation.

The survey below depicts a comparison between what companies are providing their executives nationally to what companies are providing their executives in the Tampa Bay area. While this survey is focused on publicly traded companies with $60+ million in revenue due to the prevalence of available information, privately held companies also utilize non-qualified executive benefit plans as tools to better attract and retain executive talent. It is important to note that based on the private company’s structure (C corp, S corp, etc.) the economics and value of these plans to the majority shareholders of a private company, as a plan participant, may vary based on plan design.

Source: 2008 PLAN SPONSOR NQDC Survey

As expected, the prevalence of executive benefits within larger companies was more diverse with all executive benefit types being provided at various levels. More that 50% of the larger companies surveyed ($1 billion or more in revenue) are providing deferred compensation plans and, moreover, 92% of the surveyed group provides at least one or more type of executive benefit plan. 50% of the companies between $400 million and $1 billion provided executive life insurance benefits and less than 25% of the smaller companies provided either a SERP, executive life insurance plan or executive disability income plan. No smaller companies surveyed provided a deferred compensation plan. Compared to the national survey, the larger companies in Tampa Bay are competitive as it relates to providing executive life insurance and disability benefits but lagged the market competitively as it relates to providing deferred compensation plans and SERP opportunities.

Many companies in Tampa Bay compete for talent nationally. Often times we find out that providing an executive benefit (e.g. deferred compensation plan) as part of the total compensation package can lure an executive to move for an opportunity. Alternatively, retaining talent is just as vital to the success of the business. The cost of losing an executive often times far outweighs the cost of providing an executive with a supplemental benefits platform.

Disclaimer: This material is intended for informational purposes only and should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney, tax advisor or plan provider.

More Information

For more information call (813) 367-1111 and ask for Sales, or email consulting@mezrahconsulting.com. A team member will reach out to you shortly!

Who We Are

Mezrah Consulting, based in Tampa, Florida, is a national executive benefits and compensation consulting firm specializing in plans for sizable publicly traded and privately held companies. For more than 30 years, we have focused on the design, funding, implementation, securitization and administration of nonqualified executive benefit programs, and have advised more than 300 companies throughout the U.S.

As a knowledge-based and strategy-driven company, we offer clients highly creative

and innovative solutions by uncovering value and recognizing risks that other firms typically do not see. Custom nonqualified benefit plans are administered through our affiliate mapbenefits®, a proprietary cloud-based plan technology platform that provides enterprise plan administration for nonqualified plans, including reporting and functionality for plan participants and plan sponsors.